Simple frameworks can be better than none…

Returning to a topic I focussed on in 2022, in this blog I demonstrate that when decision making in finance it is better to have a ‘bad’ framework than no framework at all - with apologies to Garry Kasparov and sundry others.

By way of example, I look at choice under uncertainty in the foreign exchange market using the simplest possible[1] hedging framework; a rules-based approach that leverages bands of standard deviations from mean.

The results I obtain follow the intuitive, as they should, but the point is that without a reasonable framework or ‘approach’ both profit seekers and loss avoiders are probably taking more risk and/or bearing greater costs than they need to.

[1] A wholly subjective assessment based on 35+ years observation of global financial markets.

Kasparov channels Sun Tzu

Countless others can lay claim to having preceded chess Grand Master Gary Kasparov in his classic hypothesis that “a bad plan is better than no plan.” The sage advice has been found in such far-flung places as a gardening handbook from 1824 England and a US Civil War policy document from 1862.

Kasparov appears to channel the Chinese military philosopher, Sun Tzu, who concluded that ‘every battle is won before it is ever fought.’ And while decision making in markets is surely unlike war or chess, we have highlighted the value planning before; see here, here, and here.

Which brings me to the question of whether bad financial market frameworks are better than not having a framework at all?

To demonstrate that the answer lies in the affirmative, I use a simplistic hedging study in foreign exchange (FX) market rates for AUD/USD, AUD/JPY, and AUD/EUR.

FX rates are non-monotonic

Why FX rates instead of interest-rate or equity market examples?

Given the simple framework I have chosen (mean-reversion) it’s important that the underlying market exhibits a non-monotonic data series. That is, a data series that (subjectively) doesn’t trend up or down endlessly over meaningful timeframes.

What we know of the long run trends in both rates and equities is that they both exhibit quite monotonic tendencies over the long run (the 25+ year bond market rally until 2022, and the long-established upward path of global equities). By comparison, the Australian dollar exchange rate (and related crosses) has traversed its long run mean on many occasions since 1990.

Figure 1. Monotonic (Left) versus Non-monotonic market processes

A simple framework

Given FX markets are well suited to mean reversion frameworks, I’ve devised (ex-ante) the simplest mechanical rules to allow analysis of what might be termed a currency hedging model.

The proposed framework’s model has two basic facets:

Prevailing FX levels are segmented into a five-band structure based on 10-year mean and standard deviations (S:D).

Mechanical trading rules (decision) are invoked subject to which of the five bands the prevailing Spot-FX rate sits within, as below.

[1] Hedgers are assumed to hedge either at the end or the start of the hedging exposure period

Table 1. Trading Bands and mechanical hedging rules[1]

The basic mechanics of the model should be immediately apparent. Exporters defer their hedging to the last moment when exchange rates are relatively unattractive and hedge at the earliest opportunity when rates are relatively attractive. Importers do the reverse. The arbitrary bands of standard deviation determine ‘levels of attractiveness’ for both exporters and importers.

It’s that simple, but to recap the framework:

Depending on where a currency is trading in relation to long-run mean hedgers can cover exposures either:

at start/inception;

at end/close,; or

randomly.

Exporter (A$ buyers) rules require hedging:

at start when A$ rates are below -1.5 standard deviations (S:D);

2/3rd at start, 1/3rd at end if the currency is between -0.5 and -1.5 S:D;

randomly if the currency is with +/-0.5 S:D around the mean;

1/3rd at start, 2/3rd at end if the currency is between +0.5 and +1.5 S:D; or

at the end when A$ rates are above +1.5 standard deviations (S:D),

Importers (A$ sellers) do the mirror opposite.

Results

Those in the business of building trading rules for a living will immediately recognise the ‘framework’ for its blunt simplicity, but that is the point. The question I’m attempting to answer is not whether one framework or model can beat another, but whether ‘simple’ frameworks are better than none at all?

And of course, intuitively we can be fairly sure that notwithstanding the simplicity of the framework it will outperform random, but what are the actual results?

To test it, I applied the framework in the following manner:

Using AUD/USD data from 1st January 1990;

add trailing 10-year mean and standard deviation;

with performance tests against random run from 1st January 2000;

assuming hedgers are exposed to a six-month forward FX contingency; and

with both exporter and importer outcomes considered.

With the following results:

Table 2. Simple framework results

In other words, for exporters the framework benefit averaged +22.3 basis points (BP), while for importers the benefit averaged +8 BP.

Which perhaps some would argue as being based on random chance. But that would be illogical since the benefits of buying low and selling high are hardly mysterious and under a random process any gain for exporters should mirror in scale losses for importers. Under our framework both importers and exporters are advantaged.

Is this a question of the underlying currency?

Likewise, the logic of the simple framework should hold up regardless of the underlying asset (or exchange rate) so long as the data is broadly non-monotonic.

Hence, I tested the framework on both AUD/JPY and AUD/EUR and obtained consistent results, though in truth I know this will work with almost any non-monotonic currency pair or asset.

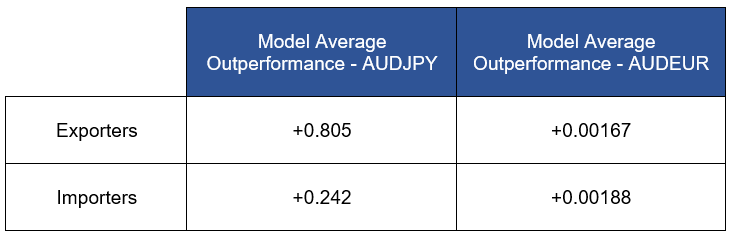

Table 3. Simple framework results, AUDJPY and AUDEUR

The pattern of results is consistent, with benefits for both exporters and importers.

Why no framework?

This brief study can’t be exhaustive, but to summarise the core questions it answered for us:

Appropriately calibrated frameworks are demonstrably better than the alternative.

Even very basic frameworks can be beneficial.

Proper framework calibration is important before implementation.

In the absence of individual skill (or good fortune), those who operate without reasonable frameworks expose themselves to random or worse outcomes.

This additional ‘cost’ is largely unnecessary and can be avoided.

In the field of investment management frameworks are common and a not onerous to construct. By far a majority of managers typically incorporate them for strategic and/or tactical asset allocations; others include them to distinguish style. Similarly, delegated authorities, limits, and other dealing controls can all be thought of as frameworks. Whether fit for purpose or not, these are designed to enhance performance (and we particularly admire those whose focus is on enhancing risk-adjusted performance).

However, as we have noted before, among the various desk reviews we have conducted there remain areas of activity in which frameworks could be applied or existing frameworks enhanced or reviewed.

Which begs the question – if frameworks can be so easily proven beneficial why not incorporate them in your process or strategy?

At Martialis, we assist clients challenged with building robust frameworks (and reviewing old ones) for decision making under uncertainty. Please feel free to reach out on this topic.