Valuation Adjustments - XVAs

Valuation Adjustments, XVAs for Derivatives

Valuation Adjustments (VAs) have been part of financial markets for many years.

More recently, the calculation methodologies for VAs have been significantly advanced and are now very quantitative involving complex models across a wide range of VAs.

As the number of VAs has expanded, they are collectively described as ‘XVAs’.

This blog is the first of a series which explains the types, uses and calculation methodologies for many XVAs. The blogs will not cover all the XVAs but will describe those frequently encountered by clients. The calculation methodologies are described in basic terms without excessive detail: if you want that level of explanation, feel free to contact me. The calculations in most XVAs vary from analytic approximations to full simulations.

This blog introduces some XVAs I regularly see for clients.

Following blogs will look at each XVA in more detail covering uses and calculation.

Why are XVAs important for derivatives?

Derivatives (e.g., interest rate swaps) have characteristics which are different to other assets and liabilities:

They have 2-way exposures, you can have payments or receipts

ii.This makes the calculation of exposure sensitive to market levels and future directions

The calculations and approaches are therefore different and often more complex than one-sided exposures such as bonds.

Bond - Cashflow is fully at rsk at default at any price

Derivative - Cashflow is not fully at risk at default because it is offset by an opposing cashflow dependent on price

Note: Some XVAs are applied to collateralised transaction and some to uncollateralised transactions.

CVA – Credit Valuation Adjustment

CVA = -LGD * ∑ (EPE * PDc)

LGD = Loss given default (assumed to be 40%)

EPE = Expected discounted positive exposure where only positive exposures are included

PDc = Probability of default of counterparty (market input)

Calculation is done in discreet time steps so that the EPE and PD are specific to that time step, and this is summed over the entire trade until maturity.

Applied to uncollateralised transactions.

DVA – Debit Valuation Adjustment

DVA = -LGD * ∑ (ENE * PDs)

LGD = Loss given default (assumed to be 40%)

ENE = Expected discounted negative exposure where only negative exposures are included

PDs = Probability of your default (market input)

Only used for accounting and generally for corporates.

Applied to uncollateralised transactions.

FVA – Funding Valuation Adjustment

FVA = ∑ (EE * FSs)

EE = Expected exposure, sum of EPE and ENE

FSs = Your funding spread

Calculation is done in discreet time steps so that the EE and FS are specific to that time step, and this is summed over the entire trade until maturity.

No LGD used

Applied to uncollateralised and some collateralised transactions.

KVA – Capital (K) Valuation Adjustment

KVA = ∑ (EC * CC * ti)

EC = Discounted expected capital profile

CC = Cost of capital

This is often a theoretical calculatio. Most banks replace KVA with RoC (Return on Capital)

MVA – Margin Valuation Adjustment

MVA = ∑ (EIM * FSs * ti)

EIM = Discounted expected initial margin (often calculated from ISDA SIMM)

FSs = Your funding spread (as per FVA)

Used only for collateralised transactions

CollVA – Collateral Valuation Adjustment

ColVA = ∑ (ECB * FSs * ti)

ECB = Discounted expected collateral balance (EE from FVA)

FSs = Funding spread of collateral x relative to discount rate

Applied to collateralised transactions.

Discount rate is the actual rate in your system, e.g., SOFR

FSs accounts for different collateral and currency

Is usually very idiosyncratic – it is your cost of collateral

E.g., discount cross currency against SOFR (mkt standard) but collateral is in JPY

Summary of Valuation Adjustments, XVAs

Uncollateralised

CVA (always a cost)

DVA (always a benefit)

FVA (cost or benefit)

Collateralised

MVA (always a cost)

CollVA (cost or benefit)

FVA (if term funding is required)

Both

KVA (always a cost)

Trade execution methodologies and strategies

This is the first in a series of blogs which will look more closely into some successful approaches to designing effective derivative and FX trade execution strategies for clients. “Effective’, in my definition is a fair outcome for both sides of the transaction which also minimises any chance of offending regulatory and legal requirements.

For example, pre-hedging is one strategy that I have found very useful (when managed correctly) to reduce risks and achieve positive outcomes for clients. It is particularly effective in managing large trades and/or illiquid markets to avoid adverse price movements.

We have written previously on the topic of ‘pre-hedging’ and how this challenging matter can present both buy and sell-side market participants with real decisions.

This blog looks at identifying a preferred outcome, developing a series of potential strategies and deciding on the appropriate strategy to follow. Future blogs will look at examples of alternative strategies, how to you may choose to implement these strategies and managing counterparties.

Identifying the preferred outcome(s)

The first step is to identify and internally agree the preferred outcomes. Basically, if you do not know and agree how you want this to end, it is hard to make plans that support that end.

Some outcomes could include:

Is there a specific price or level that is important to hit?

In some cases, there is a price point that delivers an outcome which is required for cashflow, target price, accounting simplicity etc.

Do you have any counterparties you have to include?

Sometimes relationships and/or other dependencies on a counterparty may mean they need to be part of any trade.

Are there any other counterparties you would like to include?

Is there a balance between best price and relationship?

Are there any internal parties that need to be included in decisions?

For large transactions, the board may need to be informed, and they may have some specific requirements.

Prioritise the preferred outcome(s)

The next step is to prioritise the preferred outcomes.

If you have more than one preferred outcome, then they will need to be prioritised.

In most cases, you will need to compromise on lower priority outcomes if you need to meet the highest priorities.

Look at alternative strategies to achieve the preferred outcomes

There are many ways to achieve the outcomes, but a strategy suited to the market liquidity conditions, counterparties and preferences will greatly improve the probability of a favorable outcome.

Some of the strategies include:

Single counterparty only for the trade

Running a tender involving several potential counterparties

Using a syndicate of banks who all get some of the trade

Using a single bank to execute the hedge before novating the hedges to a syndicate of banks

Single bank to arrange a pre-hedge the trade before novating to a syndicate of banks

Etc.

And note, each strategy has merits and challenges!

Deciding which strategy to adopt for this transaction

It is important to match the strategy to the preferred outcome.

Not all strategies will be effective for all outcomes

So, a decision will need to be made as to the best strategy in this situation.

Summary

The better approaches spend time and effort on making sure the outcomes are well understood (and agreed) before proceeding to the strategy to get the best chance of achieved that outcome.

Not all situations are the same so matching the strategy to the conditions is also important.

The next blog will look at examples of the strategies above. I will look more closely at the merits and better uses of each strategy and the ways they may be used to get an effective outcome.

Pre-hedging and the use of electronic execution platforms

Recently we published a podcast on the Martialis website where I discussed the development and use of electronic execution platforms with Anthony Robson. Anthony was CEO of Yieldbroker where they created the electronic trading infrastructure over 20 years and serviced the fixed income markets in Australia.

One of the topics we explored was the role of electronic execution platforms for pre-hedging of client trades by market participants. This has been a very important subject recently.

FMSB published ‘Pre-hedging: case studies’ in July 2024 which looked at the role of execution platforms in pre-hedging.

This blog looks at the FMSB case studies and relates the relevant example to my conversation with Anthony.

Recap on recent guidance on pre-hedging

Several industry and regulatory groups globally have provided guidance on pre-hedging in financial markets. We have reviewed them in previous blogs which can be found here, here, here, and also here. As you can tell, we have been busy in this subject!

One of the earliest examples of global guidance was within the FX Global Code first published in 2017. Principle 11 specifically addressed pre-hedging and was updated in 2021.

The FMSB has also updated their guidance in 2021. This has been recently supported by some case studies which are designed to assist market participants identify and manage pre-hedging activities.

The Australian regulator, ASIC, has also weighed in with a ‘Dear CEO’ letter published in February 2024. ASIC proposed 8 points which sell-side firms may use in any pre-hedging activity.

However, any advice or guidance can only assist market participants and will be subject to local regulatory and legal requirements. In other words, all market participants should pay close attention to the specific situation and their involvement in pre-hedging.

Most guidance emphasises any pre-hedging should be designed to:

Benefit the client or, at least, not adversely impact that client.

Be done with reasonable expectation of winning the trade. Note that a trader knowing they will win the trade in the very near future may not be consistent with ‘reasonable expectation’ and may constitute front running.

The role of electronic execution platforms

Returning to the FMSB, the 2024 case studies include 4 different examples of pre-hedging.

Case studies 1a, 1b and 1d all include using an electronic platform as the execution method. In all cases the client order is sent as a ‘RFQ’ (Request for Quote) in a liquid or illiquid market or product. The banks receiving the RFQ react in different ways based on whether it is a 1 or 2-way price request and/or by either pre-hedging or not. The trade is awarded to a single bank in each case.

The challenges for the banks receiving the RFQs on electronic platforms include:

Potential for the information to leak from the pricing desk to other traders thereby providing them with non-public information.

Pre-hedging may be permissible as long as it follows points 1 and 2 in the previous section.

While the time to respond to a RFQ may be very short (seconds typically) manual pre-hedging is impractical but algorithmic trading can quickly access electronic platforms. This needs to be carefully considered by banks and clients.

Illiquid markets and products present special challenges. While attempting to manage the possible position from winning the RFQ, a bank may impact the market price substantially.

I also note that the FMSB case studies include some client responsibilities to communicate clearly and honestly and be very clear about whether they accept any pre-hedging activity.

It is important to note that obligations and responsibilities impact both the intermediary (bank) and the clients.

The benefits of electronic platforms

The podcast with Anthony really highlighted using electronic platforms can have major benefits in managing risks as well as compliance with market obligations.

In the example of Yieldbroker (and I assume most platforms I have used), the electronic records of all activity are collected as a matter of routine.

There is a complete audit trail of activity that can be used for checks and analysis.

Platforms are generally required to conduct some form of surveillance to identify unusual behaviors or potential market abuse.

Orders and RFQs can be explicit about whether pre-hedging is permitted and record that agreement.

While it is possible to use another platform for pre-hedging apart from the one with the RFQ, it is possible to collect data from many platforms, check the time and activity and cross reference the pricing and trading.

Is pre-hedging permitted?

The simple answer is yes, provided it follows the rules and is agreed to by both parties.

Electronic trade execution platforms are often the dominant form of RFQ and trade execution especially in FX and fixed income markets. As such they have an important role and have functionality and characteristics which differ from voice markets.

How much is traded on electronic platforms?

The market data on turnover is difficult to gather accurately because it is spread across a number of different reporting entities including CFTC, ESMA, BIS, industry bodies such as ISDA as well as the platform providers.

However, it is generally understood that:

US and European markets trade approximately 70 – 90% of interest rate derivatives electronically due to regulatory requirements.

Around 30 – 50% of non-spot FX is traded electronically.

75 – 85% of spot FX is traded electronically.

I do note that these percentages can vary widely across regions and currencies but represent a significant proportion of the traded risk.

With relatively high percentages traded on electronic platforms, perhaps the FMSB focus on pre-hedging cases on those platforms is timely and relevant.

Summary

Electronic platforms for executing derivative and FX trades are well established and commonly used by market participants.

FMSB has recognised this and has recently provided a number of case studies of pre-hedging which related directly to the use of such platforms.

My discussion with Anthony Robson was very useful in understanding how the platforms are used and how they can provide great data for analysis of trading patterns. The complete audit trail including orders and trades can help identify when participants are trading and in what manner.

Electronic platforms are commonly used for trade execution and are very amenable to algorithmic trading: this aspect can create additional risks for market participants and may require additional controls.

In the case of pre-hedging, this could be detected by platform analytics and particular care needs to be exercised by all market participants to align their obligations to clients and markets with their trading patterns.

All the guidance in the world…

In February, ASIC released their Dear CEO Guidance for market intermediaries on pre-hedging setting out the Commission’s expectations in relation to a market practice that’s increasingly in the spotlight.

This was making good on a promise of ASIC Chair Joseph Longo, who back in 2023 noted industry’s “calls for guidance” on this thorniest of topics.

In this blog I ask a simple question: when it comes to pre-hedging, does ASIC’s (or anyone else’s) guidance matter?

‘Principles and guidance are great but they’re not enforceable. ‘

With these word’s the US-based Managing Director of a major global market association neatly summed up the rather uniquely Australian pre-hedging conundrum. Faithfully abiding by industry and regulatory guidance might be helpful, but it is only partially helpful if your trading patterns and deal outcomes appear to put you on the wrong side of the Corporations Act.

And what happens if you are on the wrong side of the Corporations Act, inadvertently or otherwise?

What we know is that it is the Corporations Act that matters. While pre-hedging situations may be rare, any ASIC investigative and/or enforcement action carries risk and almost certain business disruption (that can carry for many years).

ASIC’s Guidance

We‘ve blogged on this topic a lot in the past year, with John Feeney’s February post arguably the best of available summaries and one that helpfully provides a kind of guidance on the guidance.

Here I plagiarise in order to recap John’s points of what constitutes best practice in ASIC’s view:

Document and implement pre-hedging policies and procedures to ensure compliance with the law.

Provide effective disclosure to clients of the intermediary’s execution and pre-hedging practices in a clear and transparent manner – before any pre-hedging is conducted.

Obtain explicit and informed client consent prior to each transaction.

Monitor trade execution and client outcomes and seek to minimise market impact from pre-hedging.

Appropriately restrict access to and prohibit misuse of confidential client information and adequately manage conflicts of interest.

Have robust risk and compliance controls, including trade and communications monitoring and surveillance arrangements, to provide effective governance and supervisory oversight of pre-hedging activity.

Record key details of pre-hedging undertaken for each transaction (including the process taken).

Undertake post-trade review to determine the quality of execution for complex and/or large transactions.

ASIC went on to reminded CEO’s that:

‘failure to live up to these standards can be unfair and unconscionable.’

The market response?

It’s fair to say that the Dear CEO letter generated a lot of market interest and discussion among domestic and international firms alike. Some feel that ASIC has inserted a new higher standard with point seven.

For others, the insertion of point seven signalled the creation of what amounts to a uniquely Australian arrangement.

To recap ASIC’s pre-hedging guidance, point seven:

7. Record key details of pre-hedging undertaken for each transaction (including the process taken).

This is a definite extension of the guidance provided by both the FMSB and within the FX Global Code.

FMSB - Standard for the execution of Large Trades in FICC markets

Global Foreign Exchange Committee - Commentary on Principle 11 and the role of pre‐hedging in today’s FX landscape

And it doesn’t matter how large the underlying transactions are, the Corporations Act is in force down to the cent. The key point here is that the legislation does not appear to only refer to ‘large transactions’.

What are some of the practical risks and difficulties this creates?

It’s important to remember that when dealers are engaging in pre-hedging, they’re doing so as principals – i.e., as principal risk takers. They are also operating in risk-transfer settings, typically with multiple stakeholder interests to consider as they go about serving customers, managing an order book, and their firm’s own risks.

We also note that the dealing environment can vary between quiet periods of relative inactivity and periods of high turnover and volatility. In the latter the exercise of dealer discretion and split-second decision making are very normal, for example when market data is released or there is significant news flow.

We ask:

How do firms treat trades conducted in proximate time and price around the level of those that are recorded as pre-hedges for a specific transaction?

Is there a risk that by specifying a who-gets-what requirement for individual fills that a situation evolves where there is (real or perceived) ‘good-trades for us bad-trades for the client’ event ?

Which makes us think pre-hedge transactions should probably be recorded contemporaneously with a compliance operative present? But gosh, that adds a whole new layer of dealing oversight, complexity, and potential disruption.

We also ask, what if after all of the best compliance with ASIC guidelines, the market moves adversely against the client’s interests regardless?

There appears to be no easy answer to these questions.

So, does ASIC’s (or anyone else’s) guidance matter?

We’ve mentioned previously that we believe market intermediaries now bear a disproportionate responsibility for conflict-free, non-disruptive risk transfers in financial markets.

The latest ASIC guidance appears to add further to that burden.

We are also on the record as encouraging the development of guidelines for those who bring deals on the buy-side. But such guidance seems unlikely to emerge, at least any time soon.

In the absence of some new move to amend the Corporations Act, we therefore encourage firms to follow the guidelines with clarity, and think particularly carefully about:

documenting pre-hedging policies and procedures

recording the details of pre-hedging undertaken for each transaction

Our own mantra is worth remembering:

‘If it’s not written down it doesn’t exist.’

If it doesn’t exist, you probably have a risk you don’t need.

So yes, the guidance matters, and it matters a lot since a failure to demonstrate compliance will surely count against firms that become exposed to post-deal investigations.

The ability to demonstrably show compliance with the ASIC guidance may be all that actually protects a firm

Pre hedging and trading: A practical guide and recent experiences of balancing outcomes

With the recent regulatory interest in pre-hedging, there has been a predictable focus on how this will impact both sides of the market: buy and sell. The ASIC letter to CEOs and the impending IOSCO guidance will add to the existing FMSB and Global FX Code publications.

At Martialis, we have recently worked with intermediaries (i.e., banks) and their clients (corporates and non-bank financials) to look at the practical ways to manage trade execution within the regulatory and market practice guidelines.

This article summarises our recent experiences where the balance between the banks and their clients is managed for derivative transactions.

The buy-side

Buy-side clients are always very much on top of their balance sheet exposures. They really understand the funding and liquidity needs for their businesses and frequently use derivatives and FX to hedge exposures.

They often use derivatives as hedges against liabilities. The derivatives of choice are interest rate and/or cross-currency swaps which can be relatively simple or complex. The swaps can be restructures of existing positions or traded as new swaps.

In restructures, the same counterparty as the original trade must be in the conversation. Our observations have shown repeatedly that some banks do add cost to the trade simply because the client has little choice of counterparty; that is, they are ‘captured’.

New trades are different, they can be shown to a variety of banks and the competitive tension is much more clearly reflected in new deal pricing. The prices tend to be more aggressive, perhaps reflecting the approach that getting the deal allows for restructuring later (see the previous paragraph).

The sell-side

Banks and intermediaries have a tough balance to maintain: what is a realistic price, and does it cover my costs and required returns?

This balance can be difficult to manage and can lead to the typical dilemma: How do banks get to an attractive price while meeting target returns?

How does a trader manage risks in an existing book while not creating an inappropriate market impact that may be (or perceived to be) pre-hedging?

Sales staff are equally challenged to maintain the relationship with their client while only divulging the minimum, appropriate information to traders. Clearly there needs to be some communication, but what is considered ‘appropriate’?

In many cases, the sell-side is considering carefully the management of all trades with clients to balance the regulatory requirements.

What are we seeing?

Pre-trade market moves certainly appear to be happening, and we have seen such price moves in markets just prior to trading.

The price moves may not be associated with any potential counterparties, but it happens often enough that may not be a coincidence.

Is it pre-hedging? We cannot be certain.

Strategy is everything. For the buy-side, agreeing a clear approach before talking to any bank is imperative. As soon as we ‘break cover’ there is a possibility markets move against the client interest and/or we place banks in a position which amplifies the potential conflicts of interest.

Limiting the information provided to the banks and the timing of the release of that information can reduce risks (and costs) for both sides of the trade.

Dry runs are a must. The dry run will help align the pricing especially for restructures and complex trades. This gives us time with the client to identify outliers and negotiate the pricing well before the trade execution time.

Keep the actual execution time confidential for as long as possible. Dry runs help get pricing issues resolved but keeping the actual date and time of trading confidential minimises the potential for market moves related to the trade.

XVAs (CVA, FVA and possibly KVA) need to be priced independently. Banks can layer additional spreads into KVAs. This may be done by individual bank staff or as a corporate policy.

Getting an independent price for the trades and the XVAs before talking to potential counterparties gives our clients the ability to identify any anomalies and confirm the actual spreads they will be paying.

Just comparing prices from different counterparties is not very effective because differences in details which impact prices can go undetected. Getting a full breakdown of the trade mid and spreads means both sides can confirm the details and minimise the chance of miscommunication.

SummarY

Moves in markets just prior to trades for buy-side clients do happen. And it occurs with sufficient regularity to suggest this is not entirely coincidence. Whether this is pre-hedging or not is an open question.

However, if a bank is involved in a trade where the markets moved just prior to the execution of the trade, we recommend they look at whether there was any involvement by their traders. The activity may be unrelated, but it is better to confirm this at the time via an independent review.

A very effective sell-side practice is to look at the trade from the perspective of the client. If they intentionally move a market or pre-hedge, this may be ok if the client benefits overall. But be clear about this before the trade and review after the trade.

We are yet to see any disclosure from banks that they may pre-hedge a trade. At best it appears in the disclaimers (in the small print) but has not been explicitly discussed in our experience.

We continue to work with many market participants on both buy and sell side firms. Our best advice is to get independent and informed advice on the strategy and pricing before executing trades.

Some practical approaches to ASIC’s February 2024 letter on pre-hedging - Part 2

We published a blog in February 2024 which looked at the content of the ASIC letter for market intermediaries on ‘pre-hedging’.

That blog was focused on our interpretation of the ‘Dear CEO’ letter which was written to many banks and intermediaries. In most cases, as is normal for ASIC, the firms were required to provide a response.

A significant challenge for intermediaries is the practical application of the contents of the letter. This is further complicated by firm’s obligations under the FX Global Code and the FMSB guidance on handling large trades which offer similar but subtly different guidance to that in the ASIC letter.

It should be noted that many market participants have signed up to the FX Global Code and/or are members of the FMSB so are bound by those publications.

In addition, IOSCO is due to publish the results of a survey on pre-hedging later in 2024. This will likely add to the mix of guidance and will have the backing of many global regulators (including ASIC) who are IOSCO members.

All the codes and guidance have overlaps but also have some differences. This is to be expected because each jurisdiction is bound by their legislation and regulations which can and do differ across regions.

So, what is an intermediary to do? This blog looks specifically at the ASIC guidance and offers some practical alternatives for firms to consider when looking to comply with the Australian requirements.

Our summary of the ‘Dear CEO” letter from the previous blog

We provided this summary in the previous blog. It is a useful starting point for practical ways to address the point in the letter.

‘While consistent with global equivalents, the 8 points provide intermediaries with clear reference to the relevant Australian legislation and regulatory guidance.

It is very important to note that this is Australian guidance, and it may not be identical with other jurisdictions due to the local environment.

The challenge for many firms is the practical implementation of the contents of the letter.

How do you define which transactions will require explicit client consent to pre-hedge?

Who is an informed client and who may need additional assistance to fully appreciate the implications of pre-hedging?

How do you define and measure market impact when markets can vary in both the liquidity and the participants in each product?

How do managers oversee the pre-hedging and ensure it is consistent with regulation and guidance?

Since the guidance is a ‘Dear CEO’ letter, how does a CEO ensure compliance?’

The summary poses 5 questions which we believe are important for intermediaries to consider for pre-hedging.

We now look at each question related to the 8 points provided by ASIC and offer some practical ways to address the contents of the letter.

The 8 ASIC points with thoughts on a practical approach to compliance

The 8 separate points follow which make up the guidance. The ASIC extracts are in italics and our views are in normal script.

‘document and implement policies and procedures on pre-hedging to ensure compliance with the law. They should ideally be informed by consideration of the circumstances when pre-hedging may help to achieve the best overall outcome for clients.’

Update the current policies and procedures with reference to pre-hedging if there is no explicit mention.

This could be assisted by using pre-hedging in the examples.

Provide updated training to impacted staff which specifically includes pre-hedging as a worked example.

2. ‘provide effective disclosure to clients of the intermediary’s execution and pre-hedging practices in a clear and transparent manner. Better practice includes:

·upfront disclosure, such as listing out the types of transactions where the intermediary may seek to pre-hedge; and

post-trade disclosure, such as reporting to the client how the pre-hedging was executed and how it benefitted (or otherwise impacted) the client;’

Include an explanation of the pre-hedging practices (that this may occur) in the pre-trade discussion and written material.

Include the specific instruments that may be accessed for pre-hedging.

Explain how this will benefit the client.

Outline any risks that may be present, e.g., price moves against the client.

Make it clear that price moves may not have resulted from pre-hedging and may be a result of unrelated market activity.

We assume somebody has spoken with the client about the trade to get their request and provide a quote. Adding some specific points on pre-hedging should not be too difficult given training and some pro-forma scripts.

3. ‘obtain explicit and informed client consent prior to each transaction, where practical, by setting out clear expectations for what pre-hedging is intended to achieve and potential risks such as adverse price impact. For complex and/or large transactions, the intermediary should take additional steps to educate the client about the pre-hedging rationale and strategy;’

Take additional care when assessing ‘where practical’. For example, if the client calls urgently for a price for immediate execution, then a long conversation may not be practical. In this case, it is difficult to see where any pre-hedging could occur because there is insufficient time for it to be undertaken.

Assume it is ‘practical’ and have specific processes in place to inform the client and get their consent prior to accepting the trade or order.

Have a very wide view of ‘complex and/or large’. This is relative to the client and what each firm may not consider complex and/or large may be just that for the client.

Assess the client and the trade and explain pre-hedging accordingly.

4. ‘monitor execution and client outcomes and seek to minimise market impact from pre-hedging’

Make certain you have accurate records of all trades and times.

‘seek to minimise market impact’ should always be a goal in trading but may not always happen so be aware of the possibility of a large move.

If this does happen, then review the trades and markets to establish the cause of the move.

5. ‘appropriately restrict access to, and prohibit misuse of confidential client information and adequately manage conflicts of interest arising in relation to pre-hedging. It is critical that appropriate physical and electronic controls are established, monitored, and regularly reviewed to keep pace with changes to the business risk profile’

The nuclear option: completely separate (different rooms) the sales and trading staff and ban electronic communications except on approved channels. Back this with clear instructions of what information can be passed between them.

The other option: physically separate the sales and trading so that discussions cannot be overheard. This may mean a distance of some meters and clear instructions on moving between the 2 areas. This will be supported by clear communication restrictions.

Whichever option a firm takes, make it clear that finding ways to circumvent restrictions is not in anyone’s interest and is strictly forbidden.

6. ‘have robust risk and compliance controls, including trade and communications monitoring and surveillance arrangements, to provide effective governance and supervisory oversight of pre-hedging activity’

Most firms already have oversight of their trading activity.

We suggest checking this includes specific alerts for pre-hedging and add them if they are not included now.

7. ‘record key details of pre-hedging undertaken for each transaction (including the process taken, the team members involved, and the client outcome) to enhance supervisory oversight and monitoring and surveillance’

Points 2 and 3 should provide the necessary inputs for the record-keeping.

However, if the pre-hedging is agreed prior to the trade, a post-trade review should be done -and transparency such as this is the kind of sunlight that can prevent downstream dispute of misinterpretation.

This can be relatively automated and done as business as usual.

8. ‘undertake post-trade reviews of the quality of execution for complex and/or large transactions. This should be performed by independent and appropriately experienced supervisory team members.’

Complex and/or large trades (see point 3) should get special attention for the post-trade review.

An independent person or team should be used to remove any suggestion of ‘marking your own homework’.

If there is a client complaint, then an independent review should be conducted.

Intentional or unintentional pre-hedging

Many intermediary firms are looking at how to manage their trading books in a complex environment of actual or potential client trades which may be seen as pre-hedging.

Traders need to engage with the markets to manage existing positions, including the working of orders in a complex book. Such activity could be interpreted as pre-hedging if a client trade is transacted or anticipated. This is the problem: is this activity pre-hedging?

A post-trade review (see point 8 above) could reveal trader activity which is consistent with pre-hedging but, in fact, is just the regular and necessary book management. This is unintentional and should be interpreted as such.

Intentional pre-hedging is completely different. Trading is undertaken with the explicit intention of hedging a specific trade and would clearly need to follow the ASIC letter.

But how does the intermediary firm decide whether the hedging is intentional or unintentional. And how do they review and maintain records showing how this decision was made?

This is a difficult question and will need to be specifically addressed by each firm according to their activities and internal policies. Clear and ongoing communication of intentions seems important here.

Summary

There is no question that banks and other intermediaries have existing positions which need to be managed. But how do they balance their pre-hedging obligations described in the ASIC letter with this normal activity?

We see the only practical approach could include:

· Recognise there can be intentional and unintentional pre-hedging activity and define them as clearly as possible.

· Make sure your policies and processes are supported by clear frameworks which maintain confidentiality and separate traders and sales information (point 5) specific for pre-hedging.

· If all trades are subject to pre-hedging disclosure and explicit agreement (point 3) make sure the scripting for sales staff is very clear and outlines all required information for clients.

· Unless you are very certain the client is ‘sophisticated’ in the product and market of the trade, make very certain the scripts are followed (points 2 and 3).

· Take extra care with large/complex trades, however you define them.

· Check your record-keeping and policies for post-trade reviews.

· Consider adding specific training for pre-hedging for relevant staff to the current requirements (point 1).

There is no correct answer or quick fix.

The approach will need to be dependent on the situation, the client and firm’s existing policies.

We believe all firms should be aware of their responsibilities and make efforts to specifically address the ASIC letter. While it may be tempting to assume pre-hedging is already covered in the current policies, this may not always be the case.

The letter makes the ASIC position very clear and the fact that they have decided to send a letter to CEOs emphasizes the importance ASIC attach to the practice f pre-hedging.

I'd encourage you to expand on these slightly. It seems like an abrupt ending.

ASIC’s guidance on pre-hedging February 2024

ASIC recently (1 February 2024) released some guidance for market intermediaries on the difficult subject of ‘pre-hedging’ While not specifically mentioned, this was in the aftermath of Federal Court findings in a high-profile case of relevance.

This blog focusses on the content and provides some comments on the meaning of that guidance. Our next blog will build on the guidance and look more closely at the practical implications for both buy and sell-side firms.

ASIC also released a ‘Dear CEO’ letter which has some more detail on the obligations for intermediaries when considering and/or engaging in pre-hedging of transactions.

While ASIC acknowledge the role of pre-hedging in managing liquidity and price risks associated with client trades, there are considerable concerns about conflicts of interest. Specifically:

‘ASIC acknowledges that pre-hedging has a role in markets, including in the management of market intermediaries’ risk associated with anticipated client orders and may assist in liquidity provision and execution for clients. However, it can also create significant conflicts of interest between a client and the market intermediary which actively trades in possession of confidential information about the client’s anticipated order or trade.’

ASIC state that they have observed ‘a wide range of pre-hedging practices in the Australian market, with some falling significantly short of its expectations. Differences in pre-hedging practices can disrupt fair competition and the effective functioning of markets’.

International regulators including IOSCO, ESMA, FMSB and FX Global Code have all provided some commentary and limited guidance on pre-hedging. ASIC does point out that their guidance is in addition to and consistent with both the international practice and the Australian legal and regulatory requirements.

Our interpretation of the ‘Dear CEO” letter

The letter starts with some principles where the guidance aims to:

raise and harmonise minimum standards of conduct related to pre-hedging;

improve transparency so that clients are better informed when making investment decisions;

promote informed markets and a level playing field between market intermediaries; and

uphold integrity and investor confidence in Australian financial markets.

These principles are very clear, but the real guidance is in the section headed ‘ASIC’s Guidance’. The reference to the Corporations Act (section 912A) reminds CEOs of their obligations to act efficiently, honestly and fairly.

Eight separate points follow which make up the guidance. The ASIC extracts are in italics and our views are in normal script.

1. ‘document and implement policies and procedures on pre-hedging to ensure compliance with the law. They should ideally be informed by consideration of the circumstances when pre-hedging may help to achieve the best overall outcome for clients.’

This requirement is common to many ASIC better practices for trading financial products. The important point is to show documentation and ongoing training that supports the relevant policies and procedures.

It is imperative to ensure that the policies and procedures give clear direction on how firms decide whether pre-hedging will benefit the client.

2. ‘provide effective disclosure to clients of the intermediary’s execution and pre-hedging practices in a clear and transparent manner. Better practice includes:

upfront disclosure, such as listing out the types of transactions where the intermediary may seek to pre-hedge; and

post-trade disclosure, such as reporting to the client how the pre-hedging was executed and how it benefitted (or otherwise impacted) the client;’

Point 2 is quite clear that intermediaries need to be very specific where pre-hedging is beneficial to the client before the trading commences.

Detailed records will also be essential to support a post-trade report to the client as to how this was actually executed and how the client derived some benefit.

3. ‘obtain explicit and informed client consent prior to each transaction, where practical, by setting out clear expectations for what pre-hedging is intended to achieve and potential risks such as adverse price impact. For complex and/or large transactions, the intermediary should take additional steps to educate the client about the pre-hedging rationale and strategy;’

This point uses ‘explicit and informed’ when describing client consent and appears to preclude general comments about pre-hedging often included as footnotes to term sheets. It puts in place a requirement to obtain explicit consent, i.e., specific acknowledgement of the pre-hedging for that transaction.

There is also a need for sell-side firms to make certain the client is ‘informed’, particularly for larger or complex transactions.

We expect a ‘sophisticated client’ designation may not be sufficient to demonstrate the client is informed and aware of the detailed use of pre-hedging for a specific transaction.

4. ‘monitor execution and client outcomes and seek to minimise market impact from pre-hedging’

Proper record-keeping will be essential. Firms will need to show how they monitored the trade execution and what explicit steps for each transaction they took to minimise market disruption.

Note, markets may move as a result of firms’ pre-hedging. However, it will be up to the intermediary to demonstrate that this is for the overall benefit of the client and exercised with due diligence to not unfairly disadvantage other firms involved in relevant markets at that time.

5. ‘appropriately restrict access to, and prohibit misuse of confidential client information and adequately manage conflicts of interest arising in relation to pre-hedging. It is critical that appropriate physical and electronic controls are established, monitored, and regularly reviewed to keep pace with changes to the business risk profile’

This point is self-explanatory and follows current regulation. However, note the additional requirement to keep aligned with changes to technology and presumably monitor many channels of communication to maintain confidential material.

6. ‘have robust risk and compliance controls, including trade and communications monitoring and surveillance arrangements, to provide effective governance and supervisory oversight of pre-hedging activity’

This requirement is not new but the application to pre-hedging could be difficult to implement. We expect intermediaries will need to:

identify pre-hedging activity before commencing any trading

monitor the trading of both the teams pre-hedging and anyone else who may have knowledge of the transaction

perhaps provide oversight during and after the pre-hedging activity

7. ‘record key details of pre-hedging undertaken for each transaction (including the process taken, the team members involved, and the client outcome) to enhance supervisory oversight and monitoring and surveillance’

This point reinforces the requirements for record-keeping in the normal oversight and surveillance of trading. The focus is on the accuracy and completeness of the record-keeping after identifying pre-hedging activity.

8. ‘undertake post-trade reviews of the quality of execution for complex and/or large transactions. This should be performed by independent and appropriately experienced supervisory team members.’

The post-trade review appears to be above the requirements for other trading activity. This will likely involve all the items in point 7 above and a thorough review and report of the decisions and outcomes relevant to the pre-hedging activity.

Also note that the review is independent so Risk and Compliance teams will need to be appropriately skilled and informed.

Summary

The February 2024 ASIC guidance for pre-hedging is timely.

While consistent with global equivalents, the 8 points provide intermediaries with clear reference to the relevant Australian legislation and regulatory guidance.

It is very important to note that this is Australian guidance, and it may not be identical to other jurisdictions .

The challenge for many firms is the practical implementation of the contents of the letter.

How do you define which transactions will require explicit client consent to pre-hedge?

Who is an informed client and who may need additional assistance to fully appreciate the implications of pre-hedging?

How do you define and measure market impact when markets can vary in both the liquidity and the participants in each product?

How do managers oversee the pre-hedging and ensure it is consistent with regulation and guidance?

Since the guidance is a ‘Dear CEO’ letter, how does a CEO ensure compliance?

There are many other questions which we will address in our next blog. The focus will be on practical approaches to the guidance for both buy and sell-side firms.

Summary of the FOMC and RBA rate change expectation for Q3 and Q4 2023

I have continued to post the rate expectations for FOMC from August to December 2023.

Expectations have changed considerably in that time and reflect the changes in expectations for the inflation rate which is reflected in the market expectations for cash rates.

The following sections show the evolution of market expectations for rate changes in US and Austalia from August 2023 unti the present.

FOMC

No change to the target band since July 2023

Currently at 5.25% – 5.50%

Expectations of a rate rise have dramatically reversed by December 2023.

Now markets expect a fall of 25 – 50 basis points in Q2 2024 and continued falls thereafter

RBA

Increase of 25 basis points in November 2023 was widely expected just prior to the meeting.

Currently at 4.35%

Expectations have moved from a further 25 basis point increase to a 25% chance only.

Expectations continue to be volatile and closely follow the inflation figures with swings between 25% and 80% chance depending on the monthly CPI

Summary

Markets continue to change their expectations of cash rate moves in both US and Australia.

USA traders are pricing significant falls in the FOMC target cash rates in early 2024 while the Australian counterparts are still undecided and move their expectations as CPI data is published.

2024 is going to be an interesting year!

FOMC and RBA rate change probabilities

What do OIS and futures markets predict for the future of FOMC and RBA rate changes? This is a critical question for many traders and end-users of interest rate products.

In this blog, I will look at the two markets (USD and AUD) focusing on the OTC OIS and futures markets in both currencies. The next blog will look further into the past accuracy of the predictions immediately before the actual announcements.

Two exchanges publish expected probabilities: CME (for USD) and ASX (for AUD). In the case of CME, they publish the probabilities of various moves for at least the next 12 months. The ASX, on the other hand, only focusses on the next meeting.

The CME and ASX probabilities

The approach by each exchange is summed up as follows:

1) CME

Based on Fed Funds (EFFR) futures (i.e., monthly averages).

Uses an algorithm to calculate the probability of moves up and/or down at each meeting.

2) ASX

Based on RBA AONIA cash rate futures.

Uses an algorithm to calculate the probability of a move up or down at the next meeting.

While the approaches appear similar, in fact they are very different and based on quite dissimilar algorithms. I do not cover the algorithms used but some details for the CME can be found on their site.

I do note that there are some assumptions used by both exchanges in their calculations. The are described in the next 3 paragraphs.

CME uses the current Effective Fed Funds Rate (EFFR) which is currently 5.33% and within the target range of 5.25% – 5.50%. This is typical, in my opinion, as EFFR has tended to trade approximately 0.08% above the lower rate in the band for some time. But this is an assumption and therefore needs to be monitored.

ASX compares the calculated rate for the next meeting with the RBA Target Rate. However, the futures are based on AONIA (currently 4.07%) which has been trading at 0.03% lower than the Target at 4.10%. This is not adjusted in the ASX calculation at the moment so the ASX predicted move can be somewhat misleading as I show below.

Thes assumptions are very important to understand as they have the potential to significantly skew the probabilities relative to expectation.

A different approach

I take a somewhat different approach in each market and my calculations can differ from those of CME and ASX. I use futures prices as well as the OTC OIS market yields to ensure there is consistency across the two markets in each currency.

For example, the AUD OIS markets often trade in greater volume and longer maturities than the futures. There is a price difference between the 2 markets but this is within the bid/offer spread so I do not consider it an ‘arbitrage’.

The USD markets trade SOFR as well as EFFR in both futures and OTC OIS. With the transition from LIBOR to SOFR, the SOFR markets are much larger than the EFFR markets and so I conduct my analysis using SOFR futures and SOFR OTC OIS in place of the EFFR used by CME.

In the case of the futures markets, my approach is to calculate the step up or down at the next meeting to solve for each futures contract input. In some futures contracts, there are some days before the meeting, some after the meeting or all days are between meetings. These have to be correctly adjusted to solve for the probability.

Results and comparisons for USD

The USD results based on my calculations are quite interesting. These are shown in the following table.

All moves are from the rate today noting that EFFR and SOFR are different with EFFR around 3 basis points above SOFR.

I also add the OTC OIS implied moves alongside the SOFR futures implied move.

USD rates move probability.

The USD markets are quite consistent with the CME (EFFR) and my SOFR analysis aligning very well. This was expected but is reassuring nonetheless!

The analysis shows only about 30% probability of a 25-basis point rise between now and December with only 15% probability at the September meeting.

From January 2024 onwards, the probability of a 25-basis point fall in the Target Rate increases form 18% in January to near certain and an ~50% probability of a 50-basis point fall in May 2024.

Results and comparisons for AUD

Again, the results based on my calculations are quite interesting.

All moves are from the rate today noting that AONIA is currently 3 basis points lower that the RBA Target Rate. This difference has been in place since mid-2020 and has varied from 7 to 3 basis points.

I again add the OTC OIS implied moves alongside the AONIA futures implied move.

AUD rates move probability.

The comparison in this case is very interesting. The ASX calculation is 10% probability of a fall of 25-basis point while I calculate a 10% probability of a rise of 25-basis points!

How can this happen? It all comes from the basis of AONIA to the RBA Target where AONIA is 3 basis points lower than Target. Both the futures and OIS are based on AONIA, so the 3-basis points makes a difference.

My calculations show around 50% probability of a 25-basis point rise in RBA Target out to March 2024 noting the new RBA meeting dates from 2024.

Summary

In both the USD and AUD markets, there is good alignment of OTC OIS and futures markets for calculating the probabilities of cash rate moves in the future. This is expected but I do note these markets can differ and both need to be used in calculations as the volume traded in each market can be significantly different. I would tend to rely on the more-traded market for an accurate probability calculation.

The tables are informative and in the case of AUD, paint a more complete picture than the ASX calculations.

I plan to get these on the Martialis website and update them regularly.

Next analysis

The next blog will look back in time to see how accurate the market predictions were for FOMC and RBA rate moves (or pauses).

Simple frameworks can be better than none…

Returning to a topic I focussed on in 2022, in this blog I demonstrate that when decision making in finance it is better to have a ‘bad’ framework than no framework at all - with apologies to Garry Kasparov and sundry others.

By way of example, I look at choice under uncertainty in the foreign exchange market using the simplest possible[1] hedging framework; a rules-based approach that leverages bands of standard deviations from mean.

The results I obtain follow the intuitive, as they should, but the point is that without a reasonable framework or ‘approach’ both profit seekers and loss avoiders are probably taking more risk and/or bearing greater costs than they need to.

[1] A wholly subjective assessment based on 35+ years observation of global financial markets.

Kasparov channels Sun Tzu

Countless others can lay claim to having preceded chess Grand Master Gary Kasparov in his classic hypothesis that “a bad plan is better than no plan.” The sage advice has been found in such far-flung places as a gardening handbook from 1824 England and a US Civil War policy document from 1862.

Kasparov appears to channel the Chinese military philosopher, Sun Tzu, who concluded that ‘every battle is won before it is ever fought.’ And while decision making in markets is surely unlike war or chess, we have highlighted the value planning before; see here, here, and here.

Which brings me to the question of whether bad financial market frameworks are better than not having a framework at all?

To demonstrate that the answer lies in the affirmative, I use a simplistic hedging study in foreign exchange (FX) market rates for AUD/USD, AUD/JPY, and AUD/EUR.

FX rates are non-monotonic

Why FX rates instead of interest-rate or equity market examples?

Given the simple framework I have chosen (mean-reversion) it’s important that the underlying market exhibits a non-monotonic data series. That is, a data series that (subjectively) doesn’t trend up or down endlessly over meaningful timeframes.

What we know of the long run trends in both rates and equities is that they both exhibit quite monotonic tendencies over the long run (the 25+ year bond market rally until 2022, and the long-established upward path of global equities). By comparison, the Australian dollar exchange rate (and related crosses) has traversed its long run mean on many occasions since 1990.

Figure 1. Monotonic (Left) versus Non-monotonic market processes

A simple framework

Given FX markets are well suited to mean reversion frameworks, I’ve devised (ex-ante) the simplest mechanical rules to allow analysis of what might be termed a currency hedging model.

The proposed framework’s model has two basic facets:

Prevailing FX levels are segmented into a five-band structure based on 10-year mean and standard deviations (S:D).

Mechanical trading rules (decision) are invoked subject to which of the five bands the prevailing Spot-FX rate sits within, as below.

[1] Hedgers are assumed to hedge either at the end or the start of the hedging exposure period

Table 1. Trading Bands and mechanical hedging rules[1]

The basic mechanics of the model should be immediately apparent. Exporters defer their hedging to the last moment when exchange rates are relatively unattractive and hedge at the earliest opportunity when rates are relatively attractive. Importers do the reverse. The arbitrary bands of standard deviation determine ‘levels of attractiveness’ for both exporters and importers.

It’s that simple, but to recap the framework:

Depending on where a currency is trading in relation to long-run mean hedgers can cover exposures either:

at start/inception;

at end/close,; or

randomly.

Exporter (A$ buyers) rules require hedging:

at start when A$ rates are below -1.5 standard deviations (S:D);

2/3rd at start, 1/3rd at end if the currency is between -0.5 and -1.5 S:D;

randomly if the currency is with +/-0.5 S:D around the mean;

1/3rd at start, 2/3rd at end if the currency is between +0.5 and +1.5 S:D; or

at the end when A$ rates are above +1.5 standard deviations (S:D),

Importers (A$ sellers) do the mirror opposite.

Results

Those in the business of building trading rules for a living will immediately recognise the ‘framework’ for its blunt simplicity, but that is the point. The question I’m attempting to answer is not whether one framework or model can beat another, but whether ‘simple’ frameworks are better than none at all?

And of course, intuitively we can be fairly sure that notwithstanding the simplicity of the framework it will outperform random, but what are the actual results?

To test it, I applied the framework in the following manner:

Using AUD/USD data from 1st January 1990;

add trailing 10-year mean and standard deviation;

with performance tests against random run from 1st January 2000;

assuming hedgers are exposed to a six-month forward FX contingency; and

with both exporter and importer outcomes considered.

With the following results:

Table 2. Simple framework results

In other words, for exporters the framework benefit averaged +22.3 basis points (BP), while for importers the benefit averaged +8 BP.

Which perhaps some would argue as being based on random chance. But that would be illogical since the benefits of buying low and selling high are hardly mysterious and under a random process any gain for exporters should mirror in scale losses for importers. Under our framework both importers and exporters are advantaged.

Is this a question of the underlying currency?

Likewise, the logic of the simple framework should hold up regardless of the underlying asset (or exchange rate) so long as the data is broadly non-monotonic.

Hence, I tested the framework on both AUD/JPY and AUD/EUR and obtained consistent results, though in truth I know this will work with almost any non-monotonic currency pair or asset.

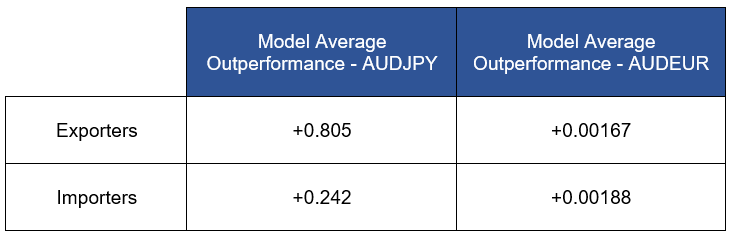

Table 3. Simple framework results, AUDJPY and AUDEUR

The pattern of results is consistent, with benefits for both exporters and importers.

Why no framework?

This brief study can’t be exhaustive, but to summarise the core questions it answered for us:

Appropriately calibrated frameworks are demonstrably better than the alternative.

Even very basic frameworks can be beneficial.

Proper framework calibration is important before implementation.

In the absence of individual skill (or good fortune), those who operate without reasonable frameworks expose themselves to random or worse outcomes.

This additional ‘cost’ is largely unnecessary and can be avoided.

In the field of investment management frameworks are common and a not onerous to construct. By far a majority of managers typically incorporate them for strategic and/or tactical asset allocations; others include them to distinguish style. Similarly, delegated authorities, limits, and other dealing controls can all be thought of as frameworks. Whether fit for purpose or not, these are designed to enhance performance (and we particularly admire those whose focus is on enhancing risk-adjusted performance).

However, as we have noted before, among the various desk reviews we have conducted there remain areas of activity in which frameworks could be applied or existing frameworks enhanced or reviewed.

Which begs the question – if frameworks can be so easily proven beneficial why not incorporate them in your process or strategy?

At Martialis, we assist clients challenged with building robust frameworks (and reviewing old ones) for decision making under uncertainty. Please feel free to reach out on this topic.

Return to the USD swap pricing basics in a post-LIBOR world

Many of our clients have noticed some pricing differences in basic USD interest rate swaps. The differences were almost entirely in swaps with maturities less than 2 years.

The differences are typically:

During the transition from LIBOR to SOFR, we were regularly seeing the quarterly adjustment spread of 24.8 basis points for the rolls after 30 June 2023. This seemed somewhat strange because the ISDA spread was fixed in March 2021 at 26.161 basis points.

More generally, we see forward-starting swap pricing differing considerably between banks.

The interbank SOFR markets are based on a 2-day settlement delay whereas many corporate trades (to match underlying assets and liabilities) have 2 or 5-day lookbacks. This results in pricing differences especially in steeply inverted rate curves.

This paper uses a simple example to demonstrate how these differences can arise in a pricing model. While this example uses linear interpolation, my testing in cubic spline interpolation gives similar results in the current USD curve.

The maturity model and algorithm

In a LIBOR pricing model, the curve for the first 2 years was typically built from LIBOR and the Eurodollar futures prices. The straight dates (e.g., the quarterly roll dates) for the spot swaps were calculated by interpolating between the implied futures yields and building the curve.

In the SOFR pricing model there is actually a choice. The SOFR markets developed from inputs more related to deposits and loans so shorter dated swaps, say less than 2-years, had basic pillar points from 1 – 12 months and then 18 and 24 months. SOFR futures did not exist when these trading conventions were developed.

As expected, the SOFR swap rates derived from the SOFR futures align with those published on screens with pillar points as described in the previous paragraph. This is unsurprising as the two markets (OTC and futures) are (and should be) very closely connected and are regularly used by many participants.

A rate for a series of one-roll, quarterly swaps can be calculated by interpolating 3-month SOFR OIS and the SOFR futures out to 2 years. The following chart and table shows this calculation based on the closes of 19 June 2023.

The curve is shown in the following chart.

I use the notation of, for example, 0X3 as a one roll swap stating spot and maturing in 3 months. The rates in the following table are derived from those shown in the chart above.

IMM Swaps when spot date is the first IMM date

I notice greater differences in forward start swaps and particularly IMM dates, i.e., swaps rolling on the IMM dates.

If the IMM dates are within a few days of the spot-start swaps, then things line up very well. This can be seen in the following table. In this case, I am assuming the current spot rate is 21 June 2023 to correspond with the June 2023 IMM date.

Note that the rates do differ slightly. This is because IMM dates are not exactly the same as the straight swap dates, so small interpolation differences will be present.

But the rates are generally quite similar and eventually solve to very similar swap rates in columns 3 and 5.

IMM Swaps when spot date is not the first IMM date

This is where the differences become meaningful. I have moved the spot date to 8 May 2023 and kept all the rates the same. This time the rates derived from the swap rates are often quite different to those of the SOFR futures which will not change.

The results are in the following table.

When I move the spot date back to mid-way between IMM dates, the one-roll swap rates and IMM date rates start to differ as seen in columns 2 and 4. Similarly, the maturity swap rates differ as well.

How can this be happening?

The explanation

This effect arises from the fact that the rate curve (as seen in the chart above) is not a smooth curve. It has a few non-linearities (i.e., it is not a straight line) which causes differences if the pillar points of the underlying curve and the swap being priced do not perfectly align.

This is also known as a double interpolation problem. It occurs quite often in swap pricing and is generally exacerbated by ‘bumpy’ input prices from futures when the spot date is between IMM dates.

I also note that the interpolation method is critical. Whether you assume linear, cubic spline or the myriad of more exotic methods, you must understand the positive and negative aspects of interpolation in short-dated swaps where differences are not averaged out over many rolls.

If you ignore the interpolation characteristics (especially for complex methodologies) then you may pay a significant ‘tuition fee’ in a pricing error.

Implications for buy-side firms

The fact that different banks can and do price forward swaps differently means you will likely see different prices for these swaps from banks. While this seems unusual, it is quite expected as they all use different interpolation and pricing methodologies.

Buy-side firms could consider forward-start swaps rather than spot-start swaps. The forward nature of the swap will often create the price differences. The best dates are usually between the IMM dates where most deviations will be maximised

Implications for banks

The golden rule is start with the underlying hedge. If you are using futures, then be aware of a possible double interpolation problem and always revert to using IMM dates to build the curve.

But if you do not use SOFR futures, then price off spot-start swaps and hedge with other banks using the same inputs. You will likely work this out by simply asking for prices and back solving to the pricing methodology.

Summary

There is no ‘absolutely correct’ methodology for pricing swaps with maturities less than 2 years. But all participants should consider:

Where is the start date of the swap relative to the IMM dates.

Whether you use SOFR futures for pricing and hedging. If so, then align the pillar points accordingly.

For buy-side, consider using forward-start swaps to achieve your best price and find the banks with the methodology which will give that outcome.

For banks, consider the hedging strategy and include this in your pricing methodology.

The interpolation method needs to be well understood. All have positive and negative features which should be considered in any short-dates swap price.

Over my many years of pricing and running books, the pricing and management of short-dated swaps is the most complex skill to acquire. Revaluation systems and pricing systems tend to be similar at banks (often the same) so a divergence between the hedging and pricing assumption will not be immediately apparent.

But they will converge at some point and the P&L will reflect the correct or incorrect assumptions.

As always, there is no free lunch.

Execution Costs – Mysterious or manageable?

One of the less well understood areas of finance is the impact of transaction costs on standard risk-reward models. While market makers with deep experience know that transaction size impacts costs, this is often not communicated to end market users in a transparent or quantitative manner.

In this first of a series of pieces, I use the efficient-market hypothesis to examine a number of hedging approaches and their impact on deal outcomes. I will show that averaging can be relatively efficient regardless of transaction size, but also that averaging’s benefits are positively correlated to deal size.

Crucially I use historic data to demonstrate that all-in cost probabilities can be quantified.

The Black-Scholes option pricing model transformed modern finance. Whereas prior to 1973 option prices could only be guesstimated, Black-Scholes presented a ground-breaking framework that birthed standardised pricing.

Coupled with the advent of the personal computer, Black-Scholes changed the manner and speed with which markets calculated risk. While arguments as to the limits of the model abound, elements of the original framework can be readily applied to advance our thinking in other domains.

In this piece I draw on the hotly contested efficient market hypothesis, which posits that market movements are essentially unpredictable, and might be thought of as a 50:50 hypothesis. I have often thought of it as simply that “markets are just as likely to go up, as they are to go down.”

As we shall see, while the hypothesis doesn’t perfectly hold, we can leverage it to assess the efficacy of different dealing execution strategies probabilistically. In this piece I use it to demonstrate that a carefully formulated execution strategy can minimise execution costs.

A market example

Let’s start by defining a simple scenario with key assumptions, of which I have chosen four:

As a hedger we are concerned about adverse market movements in the standard 3-year Australian dollar interest rate swap (IRS) market.

We are worried about adverse movements over the coming 3 months.

We have only two choices of how to execute our hedge:

a. At-Close Risk Cover - a single transaction executed at the end of three months, or

b. Progressive Risk Cover - transacting equal portions daily, accumulating in the outright exposure at the end of three months (i.e., approximately 1/60th hedged per day without exception).

All dealings are conducted at closing rates without execution costs.

I purposely chose the divergent forms of execution since they sit at extreme ends of the hedging spectrum. This is to highlight the importance of hedging strategy and the impact that deal size has on transaction costs.

For the sake of scenario framing, the following chart displays 3-year close-on-close swap yields from February 1991 until May 2023, which has been used in this analysis.

What becomes immediately obvious is that there has been a serial decline in yields (a generally rallying bond market) since 1991. We should remind ourselves that while historic outcomes don’t predict the future, the historic hedging outcomes show serial bias, and this has tended to favour swap payers.

Payers were favoured under At-Close Risk Cover ...

Under At-Close Risk Cover, the hedger is exposed to open market risk through the 3-month period, from initiation to close, with final cover being achieved only at the end-of-period closing price.

If the efficient market hypothesis held, we should expect a broadly 50:50 dispersion of favourable versus adverse outcomes, between payers and receivers.

However, as predicted, the long-term decline in 3-year yields within the dataset skews the outcome in favour of paying hedgers under the At-Close Risk Cover since 1991:

Payers, 53.46%

Receivers, 46.3%

Sum of favourable outcomes, 99.80%

Notice here that I have calculated the sum of favourable outcomes, which seems unnecessary. While this may seem superfluous the sum can be used to illustrate an important point and it gives us our results at base-100 which assists make our key point.

Notice, also, that in the case of At-Close-Cover the results do not precisely sum to 100%. This is because of 8,355 observations; a zero return was found on 17 occasions. On those dates neither payers or receivers obtained an advantage.

…. and Payers were likewise favoured under Progressive Risk Cover.

Under a Progressive Risk Cover model, it is assumed that it is possible to hedge the 3-month/3-year IRS risk at the mid-market daily close in equal daily proportions. This results in an ‘achieved transaction rate’ that is equal to the arithmetic mean of closing rates for sixty trading sessions.

The range of achieved rate outcomes (average rate minus initial rate) should still adhere to the efficient market hypothesis, that is: approximately 50:50 outcome split between payers and receivers.

Again, while our analysis uncovers a favourable bias for payers, it remains fairly close:

Payers 53.96%

Receivers 46.04%

Sum of favourable outcomes, 100.00%

And in this case the sum of favourable outcomes sums neatly to 100%.

What happens when we incorporate execution costs?

The two execution scenarios I have described here rely on the ability of hedgers to transact with perfect efficiency. That is: we’ve assumed hedging can be conducted at market-mid, which is obviously unrealistic.

So, what do we find in more realistic settings?

When transaction costs are included in our analysis, we find three things:

Favourable hedging outcomes are inversely related to transaction size under all execution approaches.

Progressive Risk Cover is more efficient than At-Close Risk Cover regardless of size,

The costs related to At-Close Risk Cover are positively correlated with increased transaction size, both nominally and relative to Progressive Risk Cover.

These findings will be unsurprising to market makers and those with deep markets experience. In fact, those who understand the nature of such costs will be right to ask, so what?

While we have proven the seemingly obvious, the point is:

The magnitude of transaction costs and their impact in large transactions, often fail to be quantitively defined for end users.

And yet there are few reasons for this lack of transparency.

While our experience in this domain would allow us to make reasonable transaction cost estimates, we have conducted soundings with market peers to arrive at indicative spreads.

The following graph collates these estimates of transaction costs and plots the impact they play on efficiency relative (based on 100 being perfectly efficient) to transaction size.

What does this show?

The difference in percentage-favourable results is quite stark.

· The blue line plots the percentage-favourable outcomes under Progressive Risk Cover,

· The red line plots the percentage under At-Close Risk Cover.

What we find is that under all deal size scenarios Progressive Risk Cover outperforms At-Close Risk Cover in terms of transaction costs. And as we noted, deal efficiencies decline as deal size grows for both approaches but maintains near-100 efficiency for Progressive.

Motive Asymmetry?

The field of behavioural finance is strewn with examples of the skewed perspectives found between those who seek to avoid risk and those who actively seek risk for profit. What should be clear is that regardless of motive, transaction costs can alter the standard efficiency paradigm no matter whether you are risk seeking or risk avoiding.

What should also be clear is that how you execute matters, and that the extent of that impact is magnified as deal size grows.

This makes specialist approaches to large or highly complex transactions a must, since a carefully formulated execution strategy can minimise both market risk and execution costs.

What next?