Term SOFR or not Term SOFR

My last paper made the case for the wider use of Term SOFR. My argument was based on the fact that the potential users of Term SOFR would only occupy approximately 1% of USD derivative turnover and would, therefore, hardly represent a systemic risk. Wider Term SOFR use, together with robust fallbacks, could significantly ease the operational risk and pressures on the end-users, i.e., the counterparties paying spreads to dealers.

On 21 April 2023, ARRC published ‘Summary and Update of the ARRC’s Term SOFR Scope of Use Best Practice Recommendations’ which reiterated and described their approach to the use of Term SOFR. The ARRC continues to recommend the restrictions on the use of Term SOFR which are reflected in the CME license agreement (CME is the administrator of the most commonly referenced Term SOFR).

The current restrictions will most likely continue to support the basis between Term SOFR and compounded SOFR, specifically Term SOFR is around 3 basis points above compounded SOFR for term (say 5 year) derivatives. This is because the restrictions encourage a one-way derivatives market where users can only pay Term SOFR but are restricted from receiving Term SOFR.

This paper looks at some alternatives to Term SOFR which may help end-users achieve the outcomes of Term SOFR without referencing Term SOFR and potentially offending the CME license conditions.

Let’s start with an example

Clients often have had loans linked to LIBOR and fixed debt issues swapped to LIBOR. The combination of floating and fixed liabilities has been managed using derivatives to the desired mix of LIBOR and fixed rates.

As assets are added or changed, the derivative market was a convenient and efficient way to trade into the desired exposure for the asset/liability balance. But this is about to change as USD LIBOR is discontinued from 30 June 2023. From July 2023 the USD market transition will force market users to alternate reference rates, including compounded SOFR, Term SOFR among others.

In the current system, a loan referencing Term SOFR can be hedged to a fixed rate using a derivative, so in this situation there is essentially no change from the situation faced under LIBOR.

However, using a derivative to swap a fixed rate debt issue to Term SOFR is not encouraged (ARRC recommendations) or permitted (CME license).

This is very clear from Scenario 7 in the ARRC publication reproduced below.

This is a significant change from the LIBOR experience.

The end-user may have a preference for Term SOFR referencing liabilities which is allowed via a loan but cannot be achieved by swapping a fixed rate debt issue to the same Term SOFR. The only way forward is to swap the fixed rate to compounded SOFR and run the basis risk between Term SOFR and compounded SOFR.

This is hardly ideal and potentially introduces new interest rate and operational risk.

Can you manage this risk using a basis swap from SOFR to Term SOFR?

The ARRC recommendations appear to allow this activity. Specifically, Scenario 8 shows the following transaction:

The accompanying commentary seems to imply this activity is permitted but the two scenarios below would not be in the spirit of the ARRC recommendations:

swap fixed coupons to compounded SOFR; then

swap compounded SOFR to Term SOFR (Scenario 8).

This does not appear to be permitted in the CME license as the Term SOFR risk is not embedded in a cash instrument, i.e., a loan.

So, the following arrangement of an end-user issuing fixed debt, receiving fixed/pay compounded SOFR and simultaneously receiving compounded SOFR/pay Term SOFR in a basis swap would not, in all likelihood, be allowed or, at the very least not be encouraged.

So, we appear to be left in a difficult situation where the end users may be forced to manage Term SOFR and compounded SOFR where previously they were only exposed to LIBOR.

Other ways forward for end-users

Many clients do not wish to manage the Term SOFR/compounded SOFR risk which they would acquire as part of a loan and fixed rate debt liability combination.

However, all is not lost. This could be managed with an active approach to the coupon dates of the debt and the calculation dates of the derivative.

Approach 1 – manage compounded SOFR to Term SOFR for a fixed debt issue:

Trade with the dealer as receive fixed/pay compounded SOFR (permitted) with terms and dates matching the debt issue.

Each rollover (coupon date), pay the USD OIS (1, 3 or 6-month as appropriate) to swap the compounded SOFR to a fixed rate to replicate Term SOFR.

While this approach achieves the desired outcome of fixing the SOFR rate for 1, 3 or 6-months, there are some challenges:

The operational risk of diarising and executing the USD OIS trades needs to be closely managed.

Term SOFR is calculated from rates across the CME trading day (see note below) and there may be slippage between Term SOFR, and the USD OIS rate traded on the day.

It is important to carefully match the settlement dates for each leg to ensure there is minimal impact on the cash management which could attract significant costs.

This approach is actually quite effective and could be a practical alternative to Term SOFR under circumstances where Term SOFR cannot be referenced.

Approach 2 – choose a point in time for your firm to fix the rate

In this approach, the firm decides on a specific time to transact the USD OIS and accepts there will likely be a difference from Term SOFR.

This is operationally much easier but can provide tracking errors if other components of the portfolio are referencing Term SOFR.

Term SOFR calculations and timing

Term SOFR is calculated in a very different way to the current USD LIBOR.

USD LIBOR is determined at a point in time, specifically 11 am London. If a firm were trying to replicate LIBOR, then trading at 11 am London in a market closely connected to LIBOR (e.g., a single period swap) would likely have little slippage.

However, Term SOFR is not calculated at a point in time.

Term SOFR is calculated as follows (CME description):

‘A set of Volume Weighted Average Prices (VWAP) are calculated using transaction prices observed during several observation intervals throughout the trading day. These are then used in a projection model to determine CME Term SOFR Reference Rates. Full details of the calculation methodology are available on the Term SOFR webpages.’

If you wish to replicate Term SOFR, you will need to trade a proportion of the USD OIS risk at each time CME accesses the price for the VWAP. This is made even more difficult because CME uses random times in each time bucket!

In practice, CME uses fourteen , 30-minute intervals with random time sampling which is not possible to exactly replicate without knowing the timing of each sample.

In practice, this makes it difficult to manage a USD OIS process to replace Term SOFR

USD OIS trades to replicate Term SOFR

Our analysis of USD OIS and Term SOFR since May 2019 (when Term SOFR was first published) gives some comfort that a practical approach could be found.

Example 1 - Trade half the USD OIS risk CME near market open and the other half near the close.

Average slippage is 1 basis point (bp).

Standard deviation is 4 bps.

Maximum is 26 bps.

Minimum is -22 bps.

The average and standard deviation are quite acceptable to many firms, but the outliers (maximum and minimum) are less attractive outcomes as the slippage is substantial.

The average slippage is within 2 standard deviations for 99.9% of time which may provide some comfort.

Example 2 – Performance over a 3-year quarterly swap traded each day.

Over the twelve rate fixes in a 3-year quarterly swap, the statistics are:

Average slippage is 2 bps.

Standard deviation is 1 bps.

Maximum is 4 bps.

Minimum is -1 bp.

The averaging process appears to be quite effective, with the maximum and minimum much reduced.

Over a 3-year swap, there may be some significant slippage days but, on average, the total outcome may be acceptable.

Summary

The recent ARRC announcements include recommendations which may allow end-users to hedge a wider group of Term SOFR exposures. But CME licensing still appears to restrict the use of Term SOFR to cash instruments and derivatives directly linked to those cash instruments.

Should the CME position change, firms could reconsider the Term SOFR use case.

In the meantime, there are practical and effective ways to replicate Term SOFR, some of which are described above.

But there are some risks and caveats:

Term SOFR is difficult to match exactly using USD OIS trades because of the timing and random nature of the Term SOFR calculation.

There can be slippage between USD OIS and Term SOFR which may cause tracking issues if parts of the portfolio reference Term SOFR.

There are operational aspects of trading USD OIS which need to be closely managed including date and settlement timing.

On the positive side:

The slippage appears to average out over time and across the rolls for a multi-roll swap.

A process could be put in place to manage the USD OIS trading and achieve quite acceptable rate fix and operational exposure.

In summary, if you need Term SOFR but are not able to access it for licensing reasons, there are alternatives.

How can Martialis assist?

Martialis can assist in this process by:

Designing appropriate operational procedures to manage the USD OIS trading and risk management;

Providing practical advice on establishing trading relationships;

Transacting and recording the USD OIS trades to ensure date and settlement matching;

Calculating any slippage to Term SOFR; and

Monitoring risks and pricing requirements.

While replicating Term SOFR appears to be complex, our experience shows this can be managed effectively and methodically if processes are robust and established proactively.

The Case for Wider Use of Term SOFR

In my last paper I looked at the trends in USD derivative turnover from BIS Triennial Surveys 2010 – 2022. In this paper I focus on the 2022 Survey and how it supports the wider use of Term SOFR than is currently permitted under existing use limits.

Many of our clients have concerns that SOFR is difficult to use compared with LIBOR. Most of their issues are related to operational problems, forward cash management and accounting calculations. LIBOR, as a forward-looking rate allows clients the time to manage their processes before settlement, whereas SOFR is a daily update which causes additional effort and forecasting. Term SOFR appears to be an easier transition as it shares many of the more desirable attributes of LIBOR.

Simply put, Term SOFR presents an easier transition from LIBOR than is compounded SOFR: CME’s own data tends to support this.

In the past I have looked at the use case for Term SOFR. Risk.net has published on this topic a few times in 2021, 2022 and 2023 outlining the various rules which are currently restricting the use of Term SOFR.

While many people, including myself, support the ARRC and Fed view that widespread use of Term SOFR may be problematic, I also believe that some easing of the restrictions may benefit end-users and not present systemic risks. This is supported by the Survey results as I explain below.

This paper looks at the 2022 BIS Triennial Survey for a breakdown of the users of SOFR and LIBOR. We can reasonably assume the LIBOR users will become SOFR users after 30 June 2023 (i.e., LIBOR cessation) so we can look at the total as a reasonable approximation of market turnover and user mix for SOFR.

Also, we could assume SOFR turnover is at or probably greater than in 2022 based on the trend in USD turnover to higher turnover over the past 10 years.

Firstly, let’s look at the product breakdown per participant grouping.

Turnover of USD derivatives by market participant groups

The Survey does provide some breakdown of the turnover of USD per market participant type. The trades are reported by Reporting Dealers and they separate their trades with other counterparties as follows:

Reporting Dealers – other banks reporting turnover;

Other Financial Institutions – financial institutions which are not Reporting Dealers (e.g., investment funds); and

Non-Financial customers – End users not included in the 2 groups above (e.g., corporates).

There may be derivative transactions between firms who are not Reporting Dealers: these trades would not be included in the Survey. Such trades could be between Other Financial Institutions so their market share may be even larger than that in the Survey.

The following chart shows the breakdown and the market percentage of each group.

The main points I see here are:

Overnight Index Swaps (SOFR) and LIBOR derivatives have comparable turnover.

Other Financial Institutions are the dominant payers with 80% of the total (SOFR + LIBOR) turnover.

Trading between Reporting Dealers is19% of market turnover and considerably less than the trading between Reporting Dealers and Other Financial Institutions.

Trading with Non-Financial customers is a minor part of market turnover and only represents 1% of the market.

Where is the turnover located?

USD is the largest derivative currency by turnover in the Survey as shown in the following chart.

Focusing on the USD, the turnover per country is varied as shown in the next chart.

USD derivatives are predominately traded in USA and UK with some turnover in other countries as well.

Conclusions from the Survey

The 2022 Survey is very clear that:

USD derivative trading is the largest by currency (44%).

The majority of that trading is in USA (68%) followed by UK (24%).

Trading between Reporting Dealers and Other Financial Institutions dominated the trading (80%).

Trading between Reporting Dealers and Non-Financial customers is a very minor component (1%).

As the USD derivatives markets, and presumably debt markets, move from LIBOR to SOFR, I reasonably expect the four points above to continue to be relevant.

How does this impact the use of Term SOFR?

The ARRC and Fed have reiterated their view that the use of Term SOFR should be restricted to a narrow range of products as described by Risk. The CME license terms for referencing Term SOFR reflect the ARRC recommendations and effectively prohibit using derivatives except between dealers to customers to hedge Term SOFR debt to a fixed rate.

The reasons provided by ARRC include to restrict the use of Term SOFR include:

avoiding a repeat of LIBOR with Term SOFR;

inter-dealer trading of Term SOFR could grow rapidly if permitted; and

trading Term SOFR could cannibalise trading SOFR itself.

The main fear is that easing restrictions on Term SOFR to allow for more use by end-users could unleash a torrent of inter-dealer and dealer to customer trading.

The 2022 Survey results do not appear to support this if trading Term SOFR had some restrictions to support dealer-customer and limited dealer-dealer trading.

The trading with end users in LIBOR (no restrictions and the vast majority of this trading based on my last paper) and/or SOFR (minimal in 2022) is only 1% of total market turnover in USD derivatives.

If all the LIBOR trading for Non-Financial customers is replaced by Term SOFR then it still only represents 1% of the market.

If interbank trading of Term SOFR was allowed (under certain restrictions) then it may also be around 1% of the market to clear offsetting risks between dealers.

So, even with a relatively unrestricted approach to allowing Reporting Dealers to trade with Non-Financial customers, the percentage of market turnover could be expected to be in the 1% – 2% range which unlikely to create a systemic problem if Term SOFR is discontinued sometime in the future.

Summary

The BIS 2022 Triennial Survey has many interesting features.

Among these is the interesting fact that trading between Reporting Dealers and Non-Financial customers is approximately 1% of market turnover in USD derivatives.

This has important implications for the use case for Term SOFR.

If trading in USD derivatives referencing Term SOFR is restricted to Non-Financial customers, then it is likely to be similarly around 1% of USD derivative turnover if all LIBOR and SOFR trading references Term SOFR.

This is not significant and would be unlikely to present systemic issues if Term SOFR was discontinued at some time.

Of course, contracts referencing Term SOFR would have fallbacks to accommodate a permanent cessation of Term SOFR.

I believe there is a good argument to allow wider use of Term SOFR for end users. A moderate relaxation of the CME licensing rules would allow a more balanced market (i.e., Term SOFR to fixed and fixed to Term SOFR derivatives) and address the reasonable concerns of the end users in the transition from LIBOR.

Bidding credit sensitivity adieu…

Credit sensitive benchmarks have been fundamental to corporate finance for many years. The loss of this sensitivity adds a systemic burden to deposit taking institutions. Why? Because corporate loan books no longer adequately reflect and compensate for the funding risk in the manner of the LIBOR-based system.

The magnitude of this mispricing depends on the extent to which corporate assets pervade bank balance sheets and the adjustment that bankers have made to lending margins. With banking sector credit risk returning to prominence recently, it is timely to look at this annoying, obscure, yet potentially impactful problem.

Our analysis concludes that while US banking market capitalisation has notably rebounded from GFC lows and appears capable of withstanding a major credit induced event; post-Libor risk-free rates may not adequately reflect the risk undertaken by lenders. This potential interest forgone is of a material magnitude.

Hypothetical Interest Forgone under SOFA during the GFC

We described some important work done by Professor Urban Jermann in our post of August 2022.

Professor Urban is Safra Professor of International Finance and Capital Markets at the Wharton School of the University of Pennsylvania, and we showcased his major work from 2021:

Interest Received by Banks during the Financial Crisis: LIBOR vs Hypothetical SOFR Loans.

This estimated the amount of interest that would likely have been forgone by US banks had US business loans been indexed to SOFR during the GFC:

“The cumulative additional interest from LIBOR during the crisis is estimated to be between 1% to 2% of the notional amount of outstanding loans, depending on the tenor and type of SOFR rate used”.

With cumulative interest forgone estimated at:

U$32.1 billion if loans had instead followed compounded SOFR; or

U$25.0 billion had they followed Term SOFR

To recap, these numbers represent the hypothetical interest income foregone if corporate facilities had been indexed against the major SOFR variants over the period 1st July 2007 and 30th June 2009.

To contextualise the GFC moves, 3m LIBOR versus 3m SOFR Overnight Index Swap (OIS) rates are plotted on the following graph. This credit sensitivity proxy is generally known as the LOIS spread.

The LOIS spread averaged 10.7 basis points for the five years prior to July 2007. This average LOIS spread rose to 89.1 basis points through the GFC, as defined by Professor Jermann.

A non-trivial amount

In a follow-up article in Knowledge at Wharton, editor-writer Shankar Parameshwaran highlights what Professor Jermann was driving at:

“The $30 billion in interest income due to the credit sensitivity of LIBOR is not a trivial amount”.

Inviting hurried back-of-the-envelope calculations, Parameshwaran calculates that:

“On March 6th, 2009, when bank share prices tanked, the top 20 commercial banks from 2007 had a combined market capitalization of $204 billion.”

According to NYU-Stern School of Business, forward price-earnings ratios for money center banks today sit at around 9x earnings.

Those wanting to interpolate what might have been should take care to note that Professor Jermann’s calculations were for hypothetical interest foregone over two years, whereas P/E ratios are based on annualised earnings measures.

Nonetheless, sector annualised interest forgone of between $12 and $17 billion (i.e., halving Professor Urban’s numbers) in an environment where stocks are trading on 9x multiples is very worrying, especially considering the sector market cap of only $204 billion.

2023 – What of the situation today?

Taking Professor Urban’s raw calculations and assumptions and applying sector asset growth, US banks across 2023/24 would likely forgo:

U$59.4 billion if loans follow compounded SOFR; or

U$46.3 billion if loans follow Term SOFR

This is a simple estimate if the credit moves of the GFC period are replicated in the coming two-year period; but system risk appears much lower given the expansive sector market caps.

For the sake of comparison, the market capitalisation of the 20 largest financials in the US sits today at around U$1.54 trillion at mid-March 2023 by Martialis calculations (U$1,541.29 billion to be precise). This represents an impressive rebound and growth of 755% since the height of the GFC.

Corporate lending has grown far less quickly.

According to the St Louis FED, total financial assets of the domestic US financial sectors grew only 85% over the corresponding period (a surprisingly large lag). For the sake of framing, it’s worth noting that the US economy is only a third larger than March 2009 in terms of annualised real GDP, so we’re within reasonable ballpark.

This suggests that the system could handle GFC like conditions, but that the interest likely forgone if GFC-like conditions re-emerge, is still quite material.

What of the latest credit stress event?

To simplify how we look at credit stress we’re starting to favour Invesco/SOFR Academy USD Across-the-Curve Credit Spread Indexes, known more generally by their acronym ‘AXI.’

AXI is starting to gain interest given its constituent make-up and methodology, and we like the clean picture of credit sensitivity it provides in USD:

AXI is a weighted average of the credit spreads of unsecured US bank funding transactions with maturities ranging from overnight to five years, with weights that reflect both transaction volumes and issuances.

AXI can be added to Term SOFR (or other SOFR variants) to form a credit-sensitive interest rate benchmark for loans, derivatives, or other products.

The historic picture of AXI across 1m, 3m, and 6-month tenors from 2018 is as follows:

Credit sensitivity is highlighted over the period of COVID market stress and more recently as bank funding costs have risen with the Silicon Valley Bank and Credit Suisse events of early 2023.

For those interested in further AXI resources, please refer to:

How is AXI tracking the current stress?

Here I compare 3-month AXI with 3-month LOIS (LIBOR-OIS) over an analogue period, starting 90-days prior to the largest jump above one standard deviation in LOIS from 2007, which occurred on 9th August 2007.

While the base of AXI commences somewhat higher than LOIS, at +19.3 versus +8.8 basis points in the ninety days to Day-0 (identified by the dotted red line), the credit sensitivity of the subsequent period shows remarkable similarities at the start of both periods of credit deterioration.

Conclusions

What is clear is that despite the move to risk-free rates (RFRs), rational investors remain rational; demanding higher risk premiums to compensate for the risk of funding banks.

What’s less clear is the extent to which banks are able to pass-on a higher cost of funds to cover their various assets; and this is a systemic problem.

While higher rates are almost uniformly beneficial across mortgage and smaller variable finance segments, it’s not clear how banks compensate for the absence of LIBOR-like credit sensitivity in their corporate assets.

With these points in mind, we encourage bankers to ask three questions:

How long will banking sector credit remain elevated?

Are we receiving sufficient compensation for corporate lending in a risk-free-rate world?

Should corporate loan margins be recalibrated accordingly?

Widespread failure to address these seems to us to have rather obvious consequences.

Term rates are crucial market infrastructure

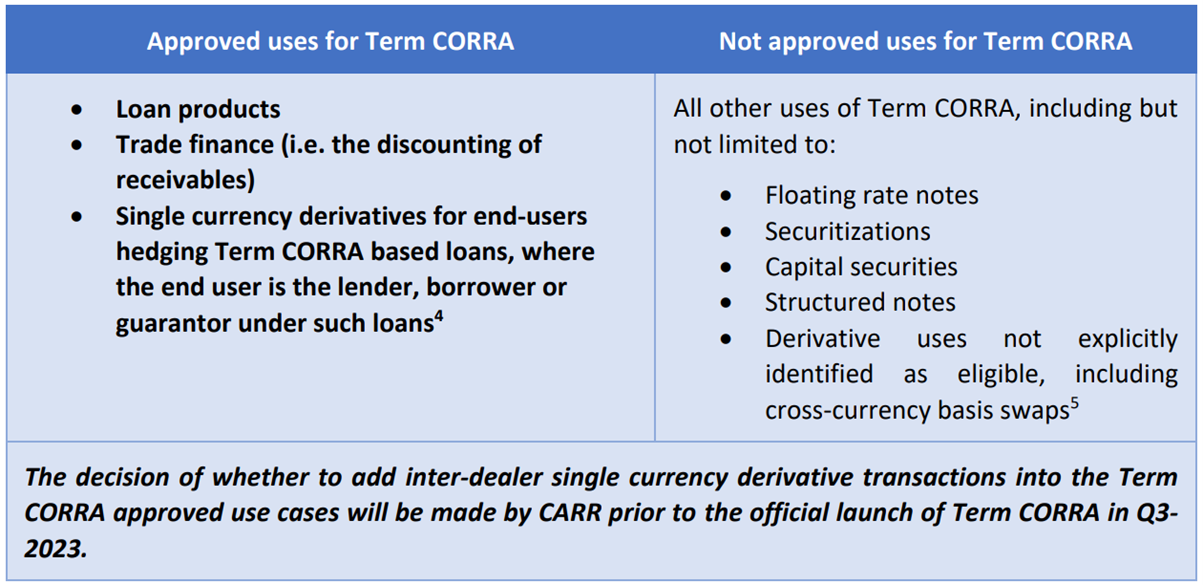

Late in 2022 the Canadian Alternative Reference Rate working group (CARR) announced it would accede to market pressure and develop a Term-CORRA interest rate benchmark.

Somewhat unusually, CARR’s announcement was made prior to release of summary responses to their consultation on a potential new term rate. This was released on January 23rd.

Leaving aside the unusual delay, it is instructive to review the summary of the consultation’s responses. As I hope to explain, survey responses to regulatory surveys such as these give us important insights into the financial infrastructure requirements of a modern economy.

The market demand for Term-CORRA is telling. It tells us that Term Rates are crucial market infrastructure, not just a addition.

Recapping CDOR’s demise

We took a look at Canadian benchmark reform last year, see here, but to recap, the principal elements within Canadian benchmark reform are:

The mid-2024 cessation of Canadian Dollar Offered Rate, CDOR, the primary interest rate benchmark in Canada since market inception, with the proposed replacement rate being:

The Canadian Overnight Repo Rate Average, CORRA.

CORRA is Canada’s official risk-free rate based on daily transaction-level data on repo trades. These measure “the cost of overnight general collateral funding in Canadian dollars using Government of Canada treasury bills and bonds as collateral for repurchase transactions,” and is thus quite similar to USD-SOFR.

Similar to the approach taken in both the UK and US, and mirrored elsewhere, CARR has published its own well-laid transition roadmap to guide participants:

Source: https://www.bankofcanada.ca/wp-content/uploads/2022/05/transition-roadmap.pdf

What had been lacking from the Canadian plan was the development of a term rate similar to Term-SONIA and Term-SOFR.

Respondents emphatic call for Term-CORRA

To address the absence of a term rate solution, on May 16th CARR surveyed Canadian market participants to “seek feedback on the need for a potential forward-looking term rate (i.e. Term CORRA) to replace CDOR in certain loan and hedging agreements.?”

The survey responses were emphatic and instructive, for example:

Question 1) Does your institution need a Term CORRA rate?

All non-financial firms “wanted a Term CORRA benchmark”.

As did a majority of financial firms.

Overall, a clear majority (37 of 42 respondents) supported its creation.

Which to our mind is as emphatic a statement of end-user demand as any consult on this topic we have seen, clearly prompting CARR’s response as announced in October:

‘In response to the overwhelming support for a Term CORRA, CARR members agree to try to develop a Term CORRA, so long as a robust and IOSCO compliant rate can be created’, my emphasis added.

However, it was the feedback received on why firms felt they needed Term-CORRA that was most instructive.

To help summarise the feedback, I have bracketed the stated respondent reasoning into two areas:

1. Functional/Operational Reasoning:

cash flow predictability, including the need for accurate cash flow forecasting given hedge accounting considerations;

operational simplicity, thus obviating the need for treasury system overhauls, and reducing operational burdens on staff, particularly among smaller firms;

reducing the liquidity risk where a significant change in interest rates were to occur towards the end of an interest-period, firms may have difficulty acquiring adequate cash to meet interest by the due date; and

as a market basis for discount calculations where a present value is needed (e.g., financial reporting).

2. Commercial/Product Reasoning:

Non-financial companies noted:

hedging loan facilities (e.g., for derivatives products to hedge term SOFR-denominated USD borrowings to a CAD term equivalent) and other term rate exposures;

transfer pricing for inter-company loans;

as a reference rate when negotiating contracts with third parties (e.g., vendors, JV partners, customers) or related entities (e.g., partnership loans);

as a rate for inventory/receivables financing;

securitization products with floating rate tranches (asset-matching); and

financial leases.

Financial companies noted:

clients’ hedging activity (i.e., where firms require hedges for Term CORRA interest rate swaps, caps and floors based on the same benchmark);

derivative products, including the hedging of Term CORRA derivatives in the inter-dealer market (as US banks offering Term SOFR products are facing substantial issues managing the associated risks);

securitisations of Term CORRA-based lending; and

where operational constraints on some of the parties to the contract limit their ability to use overnight rates.

To which we are inclined to add:

Sharia-compliant products fundamentally require forward-looking rates (i.e., to establish rates of profit in-advance);

import/export financings of capital projects, in order to forecast cash flows or arrange outgoing foreign currency denominated payments; and

trade and commodity prepayments, for a range of calculations that by definition require forward-looking rates.

Which are all reasons why Term-RFR benchmarks can’t not exist…

We have delved into the topic of Term-RFR rates from several dimensions over the past year:

All of which have served to buttress our view that term rates simply can’t not exist in post-LIBOR finance; they are fundamental to the proper working of whole industry segments.

Taking this further, we see the proper evolution of term rates (bother in RFR and credit sensitive formats) as a desirable goal for the global regulatory family, particularly given trade and capital linkages between jurisdictions.

Then there’s the question of risk dispersion

As the CARR consult respondents noted, Canadian financial respondents wanted the ability to access an inter-dealer market:

Derivative products, including the hedging of Term CORRA derivatives in the inter-dealer market (as US banks offering Term SOFR products are facing substantial issues managing the associated risks) – my emphasis again.

Our evolving view is that while use-case limits are a not unreasonable consideration, they are a) likely unnecessary, and b) possibly responsible for a build-up of essentially un-hedgeable basis risk in dealer swap books that cannot be a positive for financial stability.

And understanding the Use-Case Limits

As I explored last year in Term RFR use limits; what use are they?, if use-case limits are here to stay, firms should start considering the use-case environment and their response quite carefully:

Ensure that use-case controls prevent dealing activity that contravenes regulator or industry preferences, and/or licensing requirements.

Establish a rules-based exceptions mechanism for allowance of Term-RFR use where use is warranted, and processes that document and track artefacts where use-case exemptions are approved.

Understand the peculiar reset risk that exists where Term-RFR’s are hedged via traditional OIS products.

Define and tag Term-RFR products as such, including within risk systems where unexpected basis and reset risk can emerge (between Term-RFR and traditional OIS hedges).

Ensure key staff understand term rates, their role in finance, their use-case limits, particularly where such staff are customer facing.

For Canadian-dollar risk, we would add that it will be important to understand the subtle variation that CARR has flagged already:

This appears to open up the possibility that a Canadian term rate could trade in interdealer markets, though how that might be ‘policed’ is another matter.

To our mind it would be better if the wish list of CARR’s Canadian respondents were met fulsomely, and preferably with a generous relaxation of use-case limits – a topic which we intend to explore in greater detail through 2023.

Summing up

Canada continues to surprise markets with the evolution of CORRA, and now a Term-CORRA benchmark solution. This is in a helpful alignment to developments in the US, where CME Term-SOFR activity continues to develop apace.

Other jurisdictions should be thinking about the market infrastructure developments that the Canadians see as crucial building blocks for finance and financial markets in an IBOR world.

From where we sit it really is hats off to the Bank of Canada and their Canadian Alternative Reference Rate Working Group.

Challenges in using SOFR for all loans

Bank funding risks

Many of our clients are asking about the impact of using risk free rates such as SOFR and SONIA in loan products which allow for discretionary drawdowns. This is especially challenging in the case of revolving credit facilities and particularly those with multi-currency options.

The choices of when, how much and which currency a bank can allow a borrower client to draw down in certain products has always been a challenge to manage. For example, in times of significant stress (e.g., GFC and COVID) the clients can suddenly draw cash from revolving facilities which can create liquidity and pricing problems for the banks.

In the past, the pricing of these facilities was somewhat easier because the reference rates were intrinsically linked to credit-sensitive benchmarks such as LIBOR. When liquidity and credit was stressed, LIBOR typically rose faster than Fed Funds (i.e., the TED spread increased) and the pricing of the loan facilities reflected the increased cost for the banks. This was automatically transferred (in the most part) to the borrower as the reference rate (LIBOR) closely tracked the bank’s borrowing rate.

This affected the bank profitability, the cost of the loans based on that expected cost/return and the behaviour of the borrowers. Banks could reasonably accurately price the facility based on expected costs (additional spread) and borrower drawdowns (expected liquidity requirements) and so were generally prepared to offer competitively priced products to clients.

The recent paper published on 22 December 2022 on the Federal Reserve of New York site and authored by Harry Cooperman, Darrell Duffie, Stephan Luck, Zachry Wang, and Yilin (David) Yang looks at the possible costs and therefore pricing challenges for banks when using SOFR rather than LIBOR for certain loans.

For those whose holiday calendar resulted in them missing this important paper, I really urge you to read the full transcript. In the meantime, I will outline some of the main points and my view of how these may impact banks and their clients.

One word of caution: the authors do note that the paper does not necessarily represent the views of the NY Fed or the Federal Reserve.

Bank Funding Risk, Reference Rates, and Credit Supply – Federal Reserve of New York – 22 December 2022

The paper references some very interesting data and does some really great analysis. The work focusses on the revolving credit loans that give borrowers the option to draw funds up to the credit limit at any time under agreed terms and pricing.

These credit facilities are widely offered by banks and are often used by their clients to guarantee funding for short periods of time even when liquidity conditions in the broader market may be challenging. It is this optionality and the very real likelihood that clients will require the funds at short notice in difficult markets that dictates the terms and pricing of the facilities.

The facilities tended to use credit-sensitive reference rates (e.g., LIBOR) which reflect the actual borrowing rates for the banks at a point in time. In this case, the underlying market conditions are automatically included in the LIBOR pricing for the clients and the banks can offer these products at competitive prices and terms.

The authors look at the impact of replacing LIBOR with risk free rates such as SOFR. They run some simulations for GFC (2008) and COVID (2020) and compare the performance of the products (LIBOR plus a fixed credit spread versus SOFR plus a fixed credit spread).

Without the credit sensitivity (i.e., using SOFR), the banks would be very likely to have a lower margin (NII – Net Interest Income). This was particularly evident in GFC (-6.48 billion) while the COVID experience was lower (-1.59 billion).

This is demonstrated in the following chart used by Ross Beaney previously.

These results can be found in Section D of the paper – Accounting Counterfactual Assumptions & Additional Results, Appendix D.

Why does this matter?

The authors conclude that the choice of reference rate (LIBOR or SOFR) affects the supply of revolving credit lines.

Under LIBOR referencing facilities, the bank and the client share the embedded liquidity risk. As the market supply of funds decreases, the cost increases (i.e., LIBOR rises relative to Fed Funds) are largely passed on to the borrower. The lender (the bank) still retains some risk as their individual ability to borrow funds from the market may be impacted by their own credit compared with other banks and this may diverge from LIBOR.

Point 1

This could result in the banks increasing the pricing for revolving credit facilities linked to SOFR or restricting the supply of these products. Because the risk is now firmly with the bank, the pricing and supply must reflect a ‘worst case’ scenario where the bank has limited ability to borrow from markets and/or an increased cost.

Note that this is not such a major issue for standard, term loans. These products can be term funded at a known margin and do not have the optionality for drawdown. In this case, there is little or no uncertainty about the principal and timing of the drawdown and repayment of the loan.

The authors do not consider multi-currency revolving credit facilities in their work. In my experience, the multi-currency option creates even more issues for banks and their clients. If you use a credit sensitive reference rates for the optionality within one currency (e.g., AUD BBSW) and a risk-free reference rate for another currency (e.g., USD SOFR), then under certain market conditions, one alternative could be far better than another for the borrower. For example, with a fixed spread to SOFR, if the actual market rate is above SOFR plus the fixed spread, then the rational borrower would logically opt for the USD.

Point 2

Multi-currency revolving credit facilities present additional problems for pricing and supply of the product. A bank must reasonably use the worst-case spread for a risk-free rate or risk being drawn on the facility when liquidity spreads exceed the fixed spread in one or more currencies referenced in the facility.

Is there another way to resolve this?

Fortunately, several credit-sensitive alternatives exist which could be used to replace LIBOR and be used with or instead of SOFR. We have previously written on this subject here, here, and here.

In the USD market these include:

Across the curve Spread Indices – SOFR Academy and Invesco

Bloomberg Short-Term Bank Yield

Credit Inclusive Term Spread/Credit Inclusive Term Rate – S&P Global – not yet available for licensing.

Published by AFX

I will not describe each of these alternatives, but the links are provided for further information if you are not already familiar with the reference rates. In all cases, they have reasonably tracked LIBOR in the past and add back a level of credit sensitivity.

If Messrs Cooperman, Duffie, Luck, Wang, and Yang are correct in their conclusion that SOFR-linked revolving credit facilities may be affected (I.e., negatively compared with the outgoing LIBOR equivalents), using the newer credit-sensitive rates above may help restore the risk balance. This may allow the banks to continue to offer these products as they do now.

Summary

The 22/12/2022 paper (and I appreciate the alliteration!) highlighted some particularly important challenges in the transition from LIBOR to SOFR for revolving credit facilities. The authors rightly point out that pricing and supply of these facilities may be negatively impacted.

While they did not look at multi-currency facilities, these present even more problems for banks who now provide these to clients.

Many end-user borrowers have such facilities to ensure they can have liquidity available under all circumstances. They may be expensive but are essential components of good risk management for many corporate and investor firms.

If the supply and/or price of these products is negatively impacted, there is a real risk that the end-users may face increased risk to liquidity crises in the future.

Why debate over credit sensitive rates won’t go away…

It’s not a debate being played out around weekend barbeques, and it’s not likely to gain regular billing on 6 o’clock bulletins, but the question of whether finance needs credit sensitive benchmarks is one we’ve looked at many times – and yes, debated.

In my latest blog post I look at a rather obvious pitfall that seems likely to arise if corporate finance doesn’t settle on a credit sensitive lending solution.

Urban Jermann

Urban Jermann is Safra Professor of International Finance and Capital Markets at the Wharton School of the University of Pennsylvania. In December 2021, Professor Jermann released a topical research paper titled: Interest Received by Banks during the Financial Crisis: LIBOR vs Hypothetical SOFR Loans, which was a formal study into the cost to the US banking sector that might have been incurred (interest earnings foregone) had US business loans been indexed to SOFR reference rates (instead of LIBOR) during the two years of the GFC.

Jermann’s work is interesting from several standpoints:

He uses the expression “insurance payout” to describe the credit sensitive component of the lift in LIBOR rates through the GFC, which is both interesting and, in our view, a healthy development since banks may like to consider actuarial approaches in assessing their long run risk to credit sensitivity, and,

He calculates estimates of the “payout” LIBOR lenders received over what they would have had their loan books referenced SOFR in both compound and term formats.

He notes that:

The cumulative additional interest from LIBOR during the crisis is estimated to be between 1% to 2% of the notional amount of outstanding loans, depending on the tenor and type of SOFR rate used.

And the amounts estimated that would have been forgone by banks on loans whose economy-wide balance “may have been as high as $2trln” are meaningful:

U$32.1 billion if loans had instead followed compounded SOFR; and

U$25.0 billion had they instead followed Term SOFR.

It’s important to note, these numbers are the hypothetical reduction in interest income US banks would have borne if loans had been struck against compound or term SOFR, instead of LIBOR between June 2007 and end June 2009, and incorporate the quantum of the following US loan-types:

Syndicated loans;

Corporate business loans (bilateral),Noncorporate business loans;

Corporate Real Estate loans

Professor Jermann obtained his data from the Shared National Credit (SNC) Program for syndicated loans, and the Financial Accounts of the Federal reserve for the other categories.

All of which unearths an important question: does the loss of LIBOR’s insurance-like credit sensitivity reduce banking sector returns if not compensated?

Our answer is probably, but not if average bank funding costs settle below their long run spread to risk-free rates and stay there indefinitely.

Which makes us wonder what kind of numbers Professor Jermann might have found had he chosen to analyse the post-GFC environment since major bank funding mixes been altered so dramatically in the aftermath of the GFC?

We think it’s also interesting to note that the interest foregone by banks would have been worsened under compounded SOFR compared to Term SOFR.

Credit sensitivity since the GFC

The post-GFC numbers are relatively easy to calculate, and while we’re not going to attempt to research the quantum of loans financed through that period, we will use post-GFC USD LIBOR/SOFR OIS spreads to estimate the potential loss in basis points per annum.

We find that mean and median loss of credit sensitivity as follows:

In other words, the average annual loss of credit sensitivity yield since the end of the GFC (June 30th, 2009), was 21.4 basis points (BP) for USD facilities.

Market anecdotes

Our most recent market soundings indicate that in loan markets in the US and elsewhere lenders are:

increasingly moving towards CME (Chicago Mercantile Exchange) Term-SOFR as the basis for new USD deals, in a clear move away from compounding;

that there is no clear consensus on credit adjustment spreads (CAS); and

that lenders appear to be simply adjusting credit margins where they can do so.

By the way, this latter practice results in the same outcome as lenders negotiating a fixed CAS and simply adding this to compound or term SOFR, i.e., analogous with the basic mechanic used in the ISDA (International Swaps and Derivatives Association) Protocol for derivative transitions.

The key point is that lenders who adopt this approach are fixing the credit sensitive component of the facility, and therefore foregoing the potential “insurance payout” of a credit sensitive alternative.

Our point is (and has been) that this practice may prove problematic depending on the extent to which recent credit spreads are reflective of future.

A long-term 3-month LOIS (LIBOR/OIS spread) proxy

To prove the possible problem, we have constructed an indicative 3-month USD LOIS proxy based on an adjusted TED-Spread (3-month USD LIBOR less Treasury Bill yields) going back to 1986.

It supplies an interesting picture of the peaks and valleys of a proxy credit-sensitive rate going back well into the distant years of modern finance.

The long run statistics on the proxy are as follows:

But we think it’s important to consider the historic levels of the proxy across differing periods and differing credit environments to prove how times can change; hence we have broken the data into 5-year periods to give a perspective based on different historic periods:

This approach shows that based on 5-year bucket analysis, banking sector credit was more expensive than the ISDA 3-month spread (26.15 basis points) in all prior periods and has been relatively rarely below the mid-20s.

It also appears somewhat correlated to the general level of interest rates, which makes intuitive sense. This should give those in favour of static CAS pause for thought (a possible topic for a future blog).

AXI has gone live

Which is why we can’t see the credit sensitivity debate disappearing anytime soon.

It’s also why we took a keen interest in the recent official release of Invesco Indexing and SOFR Academy’s Invesco USD Across-the-Curve Credit Spread Indices (AXI):

The AXI and FXI indices are forward-looking credit spread indices designed to work in conjunction with the Secured Overnight Financing Rate (SOFR).

AXI and FXI work to form a credit-sensitive interest rate when used in combination with Term SOFR, Simple Daily SOFR, SOFR compounded in arrears, or SOFR Averages.

AXI is a weighted average of the credit spreads of unsecured bank funding transactions with maturities out to multiple years.

The relevant methodology can be found here.

AXI’s release joins BSBY, and IHS-Markit’s USD Credit Inclusive Term Rate (CRITR) & Spread (CRITS), in the credit sensitive reference-rate stakes.

In conclusion

It’s impossible to accurately predict which mode markets will eventually settle on, fixed estimates, or dynamic credit. Our hunch is that credit sensitive rates will become an economic necessity once the unprecedented recent compression of financial market spreads and interest rates abates.

The use of fixed spreads based on recent LOIS history could be thought to weaken the overall financial system, since it’s hard to see how the lost revenue of Professor Jermann’s “insurance payout” gets made up for in any repeat of GFC-like credit conditions, but we are not forecasters.

There is, though, the possibility that like El-Nino and La-Nina we have recently traversed a period of an unusual credit risk drought in what is a cyclical system. In that case credit sensitivity should be considered of long-run benefit.

If banking serially misprices its own costs, there can be few actual winners.

Term SOFR – Moving forward because the demand is real

We have posted quite a few blogs on this subject, notably in May 2022 and April 2022. When these blogs were published, the use cases for Term SOFR very restrictive and are defined by the Term SOFR administrator (CME).

More recently, the ARRC has reconvened the Term Rate Taskforce which was reported in the July 13 Readout. The important aspect of this group’s work is to review certain aspects of the Term SOFR uses as in the Readout:

‘The Term Rate Task Force provided an update on its discussions around term SOFR derivatives. In particular, the Task Force has been discussing participants’ views on issues/questions around term SOFR derivatives and the overnight SOFR/term SOFR basis, including clearing, capital, and accounting considerations. It was noted, however, that the Task Force is distinctly not being reconvened to materially relax the substance of the ARRC’s best practice recommendations regarding scope of use for the term SOFR rate.’

The important word is ‘materially’. This implies some changes to the use cases could be supported and therefore able to be reflected in the CME licensing rules for Term SOFR. Risk magazine has covered this topic only recently (7 July 2022) and has provided insightful perspectives on what additional use cases may address participant requirements while still adhering to the basic ARRC principle of proportionality (i.e., not allowing exponential expansion of the use of Term SOFR to keep the volumes referencing the benchmark in proportion to the underlying transactions used to calculate it).

Current CME licensing

The CME website has the following data for Term SOFR use:

Licenses from the CME are divided into 3 categories:

Category One applies to cash instruments like loans, mortgages, bonds, notes, and money market instruments.

Category Two is necessary for applying Term SOFR as a reference in any derivative product. However, the catch is that the license only covers derivatives that are directly linked to cash instruments which reference Term SOFR.

Category Three is used by specialist providers in products or services they develop and license to external clients. We do not cover this category in the blog as it only applies to service providers.

The licensing for Category Two is quite restrictive, appears to create a one-sided market and excludes potentially compliant uses for Term SOFR. In practice, Category Two requires the derivative to only use reference Term SOFR if it applies to a cash debt exposure.

Why is Category Two restrictive?

Category Two, in practice, only allows for derivatives to be used to swap floating rates (Term SOFR) associated with cash products to fixed rates. In other words, a end user can only pay fixed and receive Term SOFR in a standard interest rate swap because the Term SOFR must be associated with the cash instrument to allow a derivative to reference Term SOFR.

One example where there may be an end-user use for Term SOFR is in a derivative swapping fixed debt coupons for floating USD. SIFMA does publish the corporate bond issuance statistics for USD as summarised in the following table:

The corporate bond market is large and a significant percentage (78 – 91%) issue fixed rate. A proportion of the fixed rate issuers may decide to swap the fixed coupons to SOFR and many of these issuers are possibly in a similar operational position to the issuers of floating bonds who are permitted to use Term SOFR.

However, the fixed rate issuers cannot access Term SOFR in the swap to achieve a floating rate liability as it is not allowed in CME Category Two licenses.

Is there any real difference between the floating rate and fixed rate issuers? Arguably there is no difference except the preference of investors at a specific time.

Perhaps there is a legitimate use case for corporate fixed rate issuers to use derivatives to swap to Term SOFR and therefore an amendment to the CME Category 2 licence may be appreciated to allow a fixed to term SOFR swap.

The challenge for the ARRC and the Term Rate Taskforce

The Term Rate Taskforce has been reconvened to consider changes to the recommended use of Term SOFR given how the market has evolved since 2021. (I very much respect their challenges in finding a way to balance the proportionality with clear end-user demand!)

One advantage of allowing for derivatives which swap fixed to Term SOFR is that it helps balance the current market where only Term SOFR to fixed rate is, in practice, permitted. This could remove or reduce the current additional costs of around 1.5 to 3.5 basis points for end user borrowers in referencing Term SOFR (see the Risk article above). I do note that investors could provide the balancing side of the swap, but they could just as easily buy floating rate products (as they seem to be doing in 2022!)

Should the use cases be expanded to allow for derivatives such as the example above?

Should there be inter-dealer trading (perhaps with some restrictions) to allow banks to clear risk and provide more competitive pricing for their customers?

We will have to await the outcomes from the ARRC, but the market is showing there is demand for a less restrictive approach to Term SOFR which would need to be reflected in the CME licensing arrangements.

Summary

While we have written blogs previously on this topic, markets have changed considerably, and the tensions are very clear. The Term SOFR derivatives market is currently one-way as reflected in the basis cost of swapping floating for fixed rate.

Allowing a more balanced market where end-users can have equivalent access to fixed to floating as well as floating to fixed swaps may address some of the pricing imbalances and also provide bank customers a more complete service.

If there is a (limited) inter-dealer market then risk can be cleared more readily and banks can move the Term SOFR exposures to their trading books, thereby reducing operational and capital costs.

There is a compelling argument that end users of Term SOFR derivatives would benefit from some adjustments to the ARRC-recommended use of Term SOFR.

I hope the ARRC can adapt the recommended uses for Term SOFR and that this will be quickly incorporated into the CME Category Two licensing.

CDOR, CARR, CORRA, CAG? What’s really happening in Canada?

The Canadian Alternative Reference Rate working group (CARR) was first established in March 2018 with a remit not dissimilar to the ARRC of the US Fed, to “guide benchmark reform efforts in Canada.”

In this blog I attempt to cut an explanatory path through the maze of acronyms that loom in Canadian finance, and distil what’s really going on with Canadian benchmarks, and try to gain a better understanding of the fundamental, underlying problem with CDOR.

Are there important lessons from the Canadian experience?

Why so many acronyms?

In every jurisdiction where benchmark reform has been attempted, new market acronyms abound.

This has been without exception, though we’d concede that the Bank of England Working Group on Sterling Risk-Free Reference Rates has seemed to defy market ‘acronymisation’!

Canada has been no Robinson Crusoe in this evolution, though the list of reform acronyms could be said to have been taken to new lengths in terms of sheer number. We’re sure this was not deliberate, but with so many new terms mixing with old terms it’s somewhat instructive to recap what they all stand for, and what role they play:

Canadian Dollar Offered Rate, CDOR, is administered and published daily by Refinitiv Benchmark Services. The rate was developed in the 1980s as the basis for pricing Bankers’ Acceptance supported credit facilities (short-term corporate promissory notes backed by an unconditional payment obligation of a bank). It has remained the primary interest rate benchmark in Canada since inception and is referenced in over $20 trillion of gross notional exposure across the Canadian wholesale financial system.

Canadian Alternative Reference Rate Working Group, CARR, was created through the sponsorship of the Canadian Fixed-Income Forum, to coordinate Canadian interest rate reform and “ensure Canada’s interest rate benchmark regime is robust, relevant and effective in the years ahead,” with objectives to:

o support and encourage the adoption of, and transition to, the Canadian Overnight Repo Rate Average (CORRA) as a key financial benchmark for Canadian derivatives and securities; and

o analyse the current status of the Canadian Dollar Offered Rate (CDOR) and its efficacy as a benchmark, as well as make recommendations on the basis of that analysis.

Canadian Overnight Repo Rate Average, CORRA, Canada’s official risk-free rate based on daily transaction-level data on repo trades that measure “the cost of overnight general collateral funding in Canadian dollars using Government of Canada treasury bills and bonds as collateral for repurchase transactions”. The Bank of Canada considers CORRA a public good and publishes rates at no cost to users and data distributors each business day at 11:30 am Canada Eastern Time.

CORRA Advisory Group, CAG, was initially established to advise the Bank of Canada’s CORRA Oversight Committee on potential adjustments to the CORRA methodology, “stemming from changes in repo market functioning and from any emerging methodology issues, as well as on any changes undertaken as part of regular methodology reviews.” A key role of CAG is to assess if CORRA continues to represent the overnight general collateral funding rate where Government of Canada securities are posted as collateral.

While to-date no formal Term CORRA rate has emerged, I note that Canadian industry demand for a CAD term rate is like that found in other jurisdictions (high, reasonable, and in our view very rational), and that CARR has a Term CORRA subgroup reviewing the need for “a complementary term rate to overnight CORRA for loan and related hedging products.” This welcome group is also expected to develop an appropriate methodology.

So, what’s the plan?

Similar to the approach taken in both the UK and US, and mirrored elsewhere, CARR has published its own well-laid transition roadmap.

Source: https://www.bankofcanada.ca/wp-content/uploads/2022/05/transition-roadmap.pdf

Readers with experience of the Bank of England roadmap to GBP LIBOR’s cessation will note the similarities:

announce a formal cessation trigger;

establish a ‘no new LIBOR (CDOR)’ exposure cut-off date; and

set a formal publication cessation date in stone.

We see no reason for Canadian markets to struggle with any of this, and market disruption should be minimal; the global template for cessation has essentially been set.

What’s the problem with CDOR?

Helpfully, CARR’s formal review of CDOR is available on-line, and I am leaning on it heavily through this section

After consulting with industry through 2021, and as outlined in the transition roadmap, CARR formed the view that Refinitiv Benchmark Services (RBSL) should cease the calculation and publication of CDOR after June 30, 2024.

My key question is, why was this?

CARR is explicit here, saying that “there are certain aspects of CDOR’s architecture that pose risks to its future robustness.”

What risks?

Here I paraphrase the two key risks CARR found, and which we believe are fundamental, to make summary easy:

Input rates crucial to CDOR’s publication cannot be directly tied to observable transactions, and are hence “based predominantly on expert judgement”. CARR decided that this was “not consistent with evolving global best-practices” nor, we would add, was this consistent with IOSCO Principles for Financial Benchmarks.

CARR noted that Bank funding has evolved to “better match the term of their funding to the term of their loans, and this practice is now codified in Basel III regulation”. Further, CARR noted that “BA loans are “term” or “committed” facilities, bank treasuries no longer fund them through the issuance of BA securities that are generated through the loan drawdown”. The reduction of bank acceptance issuance tolls a rather obvious bell.

CARR also noted that the move away from CDOR “aligns Canada with the heightened standards other jurisdictions began adopting in 2018,” and that the rate’s “contributing member banks may decide they no longer wish to continue submitting rates voluntarily.”

These are interesting other riders; hinting at a desire on behalf of the working group, and presumably others across Canadian finance, to follow the benchmark modernisation path seen across the US, UK, Japan, and Switzerland.

Boiling it all down?

When CARR tell us that “there are certain aspects of CDOR’s architecture that pose risks to its future robustness,” I am at once reminded of the fall in interbank (LIBOR) lending that has occurred since the mid-90s, and prominently since the GFC, as displayed in the classic St Louis Fed graphic on the topic:

Source: https://fred.stlouisfed.org

In Canada, the pattern has been familiar; bankers’ acceptances are simply no longer playing the significant role they once played in Canadian finance.

Short-term paper held on financial balance sheets has fallen to around 1% of the national balance sheet since Y2k:

Source: Statistics Canada. Table 36-10-0580-01 National Balance Sheet Accounts

Perhaps more interestingly, since the GFC short-term Canadian paper has hardly registered as meaningful liabilities on the non-financial sectors cumulative balance sheet either:

Whichever way CARR may like to couch it, dire levels of actual BA activity really has spelled the end of CDOR.

Important Lessons?

Our interest in Canada as a benchmark test-case stems from the similarities between Australian and Canadian finance, where bank accepted securities play and have played a key role in benchmark formation in both countries.

We will look more closely at the Australian benchmarks in the next blog.

Perhaps the most important lesson from Canada is that times change, and that rational actors will act rationally. Market evolution, some pushed along by natural market evolution, and some pushed along by regulators, needs to be carefully watched, and shouldn’t be ignored.

We continue to watch this space with deep interest.

Term RFR use limits; what use are they?

It’s a long time since anyone disputed trade liberalisation as a force for economic good.

Likewise, it’s a long time since anyone questioned the value of liberalised financial markets in promoting the efficient movement of global capital.

So why are global regulators defining use-case preferences or limits on the use of Term RFRs? Why are lay out hurdles that restrict us?

In this blog I explore this topic and present some suggestions on how to negotiate the use-case minefield that has emerged.

Liberalised markets

It’s a long time since anyone seriously disputed trade liberalisation as a key driver of economic growth. Likewise, it’s a long time since liberalised financial markets were claimed to detract from the efficient allocation of capital and resources across economies.

Financial markets work best when they’re liberalised. For one thing, risk transfer and risk dispersion take place more efficiently when there are deep pools of market activity. For another, pricing transparency is advanced in markets where participation is not discouraged; and these are both aspects of what the Big Bang was ultimately all about.

Step forward to the 2020’s and the freedom of a truly ubiquitous financial benchmark is making way for a collection of replacement rates, including a serious suite of new term rates that we’ve written about before, (see here, here, and here). What seems somewhat at odds with liberalisation is that these rates appear to be emerging somewhat less free depending on the jurisdiction they are based.

We notice that all of the Term-RFR variants outside Japan are accompanied by regulator preferences and licencing restrictions that are likely to govern how they’re used. We’re not convinced these are helpful, but we can’t deny their existence.

Regulatory Pressures

Paraphrasing key quotes and/or summarising measures from across the regulatory landscape, the use-freedom of term rates appears to have been deliberately crimped:

They (term rates) are by their nature a derivative of RFR markets. Because these RFR-derived term rates would be based on derivatives markets, their robustness will depend on derivatives market liquidity. Activity in these derivative markets may, however, be relatively thin and vary significantly with market conditions, including on expectations about central bank policy changes.

Moving the bulk of current exposures referencing term IBOR benchmarks that are not sufficiently anchored in transactions to alternative term rates that also suffer from less liquid underlying markets would not reduce risks and vulnerabilities in the financial system. Therefore, because the FSB does not expect such RFR-derived term rates to be as robust as the overnight RFRs themselves, they should be used only where necessary.

Bank of England Term-SONIA

In January 2020, the Sterling Working Group recommended a limited use of Term SONIA.

If use of a TSRR became widespread, there is a risk of reintroducing structural vulnerabilities similar to those associated with LIBOR. While several hundred $trillion worth of financial contracts reference LIBOR, the underlying market determining the rate was comparatively smaller.

These risks can be avoided by limiting the use of TSRRs.

The areas identified as being potentially appropriate for Term SONIA uses were:

smaller corporate, wealth and retail clients. However, the Task Force noted that other rates such as fixed rates or the overnight Bank Rate (see further below) should be considered as well;

trade and working capital financing, which use a term rate or equivalent to calculate forward discounted cash flows to price the value of assets in the future;

export finance and emerging markets, where the customer typically requires more time to arrange and make payments; and

Islamic financing which can pay variable rates of return, so long as the variable element is predetermined.

FMSB Standard on use of Term SONIA reference rates

Noting that FMSB members agree to abide by FMSB Standards in their business practices, we note the wide reach of this standard in UK term rate use.

Term SONIA is derived from executable quotes for SONIA-based interest rate swaps. Its robustness therefore depends on the liquidity in such swap markets, so it is in the interest of all potential users of Term SONIA for those markets to remain primarily based on overnight SONIA. If the volume of swaps data available is not consistently as large as in overnight funding markets, then Term SONIA cannot be as robust as overnight SONIA.

The standard then loosely defines possible use cases across lending, bonds, and derivative markets, repeatedly imploring market participants to assess use case limits “in a manner consistent with this Standard.”

It makes little attempt to be prescriptive.

FED ARRC Term-SOFR

Use of the SOFR Term Rate should be in proportion to the depth of transactions in the underlying derivatives market and should not materially detract from volumes in the underlying SOFR-linked derivatives transactions that are relied upon to construct the SOFR Term Rate itself over time and as the market evolves. Like all the ARRC best practices, the extent to which any market participant decides to implement or adopt any benchmark rate is voluntary.

On 29 July 2021, ARRC formally recommended CME Group’s forward-looking SOFR term rates.

ARRC did not impose similar restrictions on the use of Term SOFR as seen with Term SONIA, instead leaving CME Licencing rules to govern use limits (see below).

CME Licencing CME Term-SOFR

The CME’s licencing regime maintains three categories of use (described within Use Licences) which combined, broadly conforms to the ARRC’s Best Practices guide:

Category 1 – Use in Cash Market Financial Products;

Category 2 – Use in OTC Derivative Products; and

Category 3 – Use in Treasury, Risk & Transaction Admin Services.

However, Term-SOPFR’s free use in a traditional liberal OTC setting is not assured, and this is crucial:

Use of CME Term SOFR Reference Rates only as a reference in an OTC Derivative Product that is tied or linked to a licensee and End User hedging against exposure from one or more Cash Market Financial Products that references the same CME Term SOFR Reference Rate.

We read this as a serious control, likely to crimp activity.

SNB National Working Group on Swiss Franc Reference Rates

Imposing a complete term-rate limit, the SNB considered it unlikely that a robust SARON term rate could ever be feasible and recommended that market participants use compounded SARON wherever possible.

Working Group on Euro Risk Free Rates (ECB / ESMA)

While the joint working group recommended a forward-looking term rate for €STR, derivative markets based on €STR are not yet sufficiently liquid to permit the endorsement of a forward-looking term rate, despite having announced an RFP process in July 2019. No target date for the publishing of such a term rate exists at this stage.

To an extent this is less problematic in EUR, since Euribor continues to be published.

TORF becomes the outlier

Somewhat surprisingly, Japan has taken the liberal path to term-rates.

In Tokyo, the Tokyo Term Risk Free Rate (TORF) is published by Quick Corp. Since May 2020, this has been based on uncollateralised overnight call rate which calculates the interest rate from JPY Overnight Index Swap (OIS) transaction data.

Unlike other major jurisdictions, neither Quick nor the Bank of Japan has (so far) placed any limitation on TORF’s use, which would appear to make Japanese financial markets the most liberalised on the planet for Term-RFR rates.

So, why limits?

Our reading as to why a collection of use-limits has unfolded is quite simple; the robustness of new benchmarks is of paramount importance to a regulatory family bruised by the fact that LIBOR robustness fell so far. They don’t wish to see a repeat.

What’s also clear is that the robustness of Term-RFR is always and everywhere dependent on the derivatives market liquidity of related OIS and RFR futures markets, which are implied-forward RFR markets. The proper functioning of the term rate system therefore depends on the viability of these implied forwards, which themselves must be kept robust.

It is not hard to imagine what could happen if a particular Term-RFR market started to cannibalise the liquidity of its own underlying rate.

We view this as a particularly unlikely scenario since OIS and RFR-Futures markets are developing and have almost limitless liquidity potential (they are implied, not physically supplied). We also see Term-RFR fallbacks as an important risk-mitigant. Nonetheless, we have to acknowledge that the regulators have a serious point to make, and they appear to have made it via their use-case preferences.

Practical Implications

While expounding its use-case preferences for Term-SOFR, the FED’s ARRC noted that: “each market participant should make its own independent evaluation and decision about whether or to what extent any recommendation is adopted.” Which seemed to throw the use-case ball into the welcoming arms of individual firms, but with the CME licencing regime taking the shape that it has the ARRC’s use-case wish-list has emerged more practically within the licence.

This effectively swamps all sense of “independent evaluation and decision” (making) on the USD term RFR scene.

Conceding that participants are generally still grappling with the wider ramifications of LIBOR cessation, and the uncertain new world of compound or simple RFR’s, the use of term rates is patchy. Nonetheless, firms should start considering the use-case environment quite carefully to:

Ensure that use-case controls prevent dealing activity that contravenes regulator or industry preferences, and/or licencing requirements.

Establish a rules-based exceptions mechanism for allowance of Term-RFR use where use is warranted, and processes that document and track artefacts where use-case exemptions are approved.

Understand the peculiar reset risk that exists where Term-RFR’s are hedged via traditional OIS products.

Define and tag Term-RFR products as such, including within risk systems where unexpected basis and reset risk can emerge (between Term-RFR and traditional OIS hedges).

Ensure key staff understand term rates, their role in finance, their use-case limits, particularly where such staff are customer facing.

At Martialis we have immersed ourselves in the complexities of RFR’s and the conundrums associated with Term-RFR’s. We are well placed to guide firms as they negotiate the path through the new rates, associated products, and the various use-case minefields.

Credit Sensitivity Perspectives

The transition to multi-rate benchmarks was always going to raise some fundamental questions regarding post-LIBOR deal pricing.

In this blog I take a closer look at simple proxies for USD credit sensitivity using historic data available at the St Louis FED. The findings are quite consistent with what we should expect intuitively, but in contracting for new deals it’s worth considering the historic path of credit sensitivity and whether exposure to it is advantageous.

We believe participants need to understand the new offerings. The availability of both credit sensitive and credit insensitive offerings makes this somewhat more important, since those found to have accepted an unnecessary path run the risk of being challenged to explain their reasoning.

Historic credit sensitivity

There are many different approaches to identifying periods of financial-sector credit stress. In this piece I have chosen to rely on a very simple proxy stress measure; the historic difference between USD AA-rated commercial paper (CP) of financials and the corresponding CP of AA-rated non-financials at the 3-month tenor.

(FinCP – NonFinCP) = FCP Indicative Risk Premium

The data I’ve used comes courtesy of the repository kept by the St Louis FED, which is an excellent source for those interested in this kind of analysis.

Intuitively, the interest rate spread between AA-rated financials and non-financials should track quietly between extended periods of stability and periods of intense fluctuation in which the yield of financials jumps relative to that of non-financials.

And this is the historic pattern over the past 25 years of the data, which I’ve displayed below. I have labelled some of the key events of that time.

Which is consistent with the picture of the typical market stress measure used by dealers:

(LIBOR – SOFR OIS) = Indicative Risk Premium

Using the slightly shorter dataset available for 3-month USD LIBOR versus SOFR OIS (as implied by the FED’s Term-SOFR proxy).

I then compare the various standard statistics of the indicative risk premia, the results of which are displayed in the following table:

We find that 3m LIBOR exhibits a consistent margin above AA financial paper, at an average +21.3 BP, which is +13.7 BP higher than AA bank funding spread (as defined by 3-month financial CP) through time.

In periods of market stress LIBOR’s excess premium jumped as high as +89.5 BP in 2008, coincident with the excessive market stress event of the Lehman Brothers collapse of October 2008 (the GFC).

Replicating this with the LIBOR – SOFR OIS spread we find the excess premium somewhat more pronounced and more volatile.

Incidentally, in looking at the 3-month LIBOR – SOFR OIS data (term-versus-term rates) the five-year mean of rates to March 5th, 2021, is slightly different to the ISDA Credit Spread Adjustment announced that day; 28.2 BP versus 26.1614 BP for the ISDA. This is due to the difference between the SOFR compounded in-arrears calculations of the ISDA (backward-looking) versus the implied Term-SOFR of the SOFR-OIS rates used here (forward-looking).

Major stress events mapped

To identify historic market stress events consistently, I search for periods of more than single days where 3m financial rates exceeded non-financials by one standard deviation or more (i.e., greater than +23.6 BP (7.6 + 16.0 BP)).

The following bar graph looks more like a commercial bar-code, but each blue period is an individual stress period identified using this approach.

The dominant stress events of the GFC bouts (both 2007, and 08) are clearly shown.

Stress since 2006

Across the 25 years of St Louis FED data there have been 11 credit stress events using this simple measure, however only 10 of these seem viable.

Viable?